Australian fintech firms raise over $2.7b from 2015-2019

Deals over $100m comprised 41.9% of capital raised.

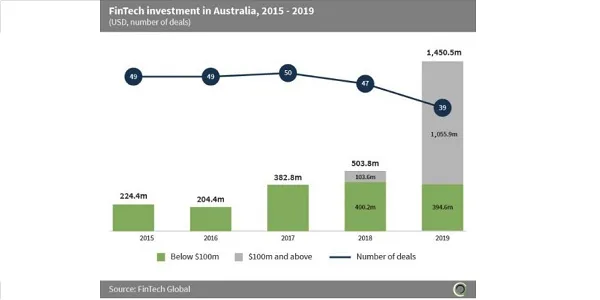

Australian fintech firms raised over $2.7b (AUD39.b) across 234 deals between 2015 to 2019, according to FinTech Global. Deals over $100m (AUD145m) made up 41.9% of the total capital raised.

Investment multiplied at a compound annual growth rate (CAGR) of 59.5% to $1.45b (AUD2.11b) across 38 deals in 2019 compared to 2015. Average deal size rose eight times from $4.6m (AUD6.6m) in 2015 to $37.2m (AUD54.1m) in 2019. Of this capital, 72.8% was invested in transactions valued at or above $100m (AUD145m).

The report also noted that over $1.3b (AUD1.8b) has been raised in the top 10 fintech transaction last year, accounting for 47% of the total capital raised in the country during the period. Wealth management firm AMP raised the largest deal of the year with $650m (AUD446.29) in a Post-IPO-equity round in August 2019.

Advertise

Advertise