Chart of the Week: Korea's internet-only banks still sparring for market share

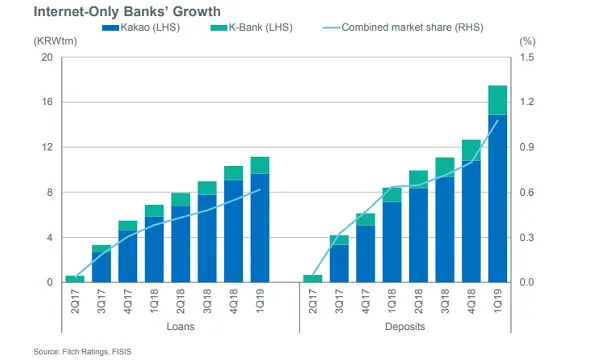

The two players only account for 0.6% of the loan market in Q1.

Two years since their debut in 2017, Korea's two internet-only banks have grown at a breakneck pace, steadily growing their loan and deposit pool as they beneift from a low base, according to Fitch Ratings.

Also read: South Korea's web-only banks lose steam as they book massive half-year losses

Kakao Bank which launched in July 2017, saw its deposits hit the $8.25b (KRW10t) mark in January 2019. It also amassed a customer base of 10 million or about 20% of the country's entire population in July. Similarly, K bank which launched ahead of Kakao Bank enjoyed similar growth rates.

"The rapid development of virtual banks in Korea will continue to put pressure on the incumbents to make their business models more efficient and agile," Fitch Ratings said in a report.

However, the disruption posed by the two players are only modest as they command less than 1% of the country's loan market at around 0.6% and over 1% in the deposit market in Q1.

Also read: Korea's virtual banks still struggle to find footing

“Korea’s two virtual banks have brought modest competition in some retail loan segments but no broad disruption in the two years they have been operating,” Moody's said in a previous report.

The two players are also having trouble turning a profit as return on average assets (ROAA) stands at a relatively low at -0.9% in December 2018 as they turn to competitive pricing to jockey for market share, data from Moody's show. The latest figure, however, marks an improvement from -7.2% in December 2017.

Advertise

Advertise