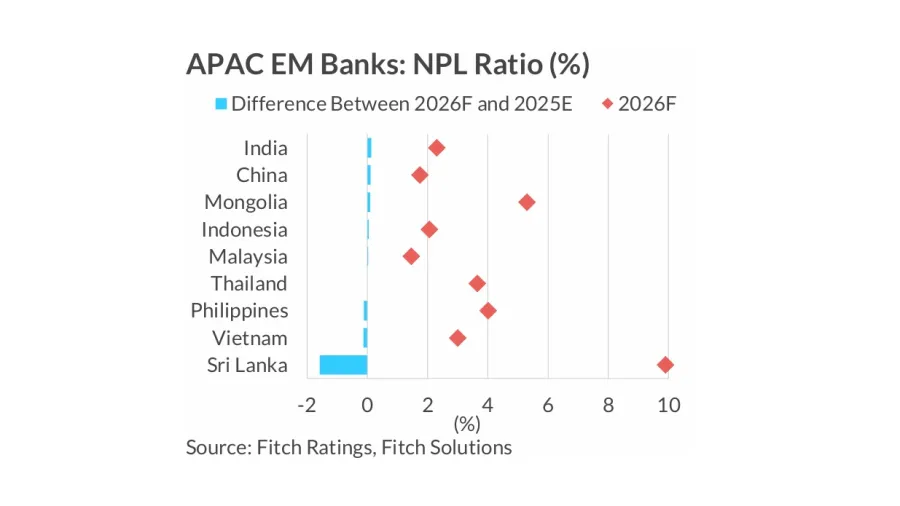

APAC EM banks face rising bad loans in 2026

Risks are potentially highest in China, Thailand, the Philippines, Mongolia, and India.

APAC emerging market banks will face weakened repayment capacity of households and small businesses in 2026.

“Weakened repayment capacity of household, micro and SME borrowers – which could be driven by softer growth or employment/income than anticipated – would elevate asset-quality risks in several markets,” Fitch Ratings said in its “Asia-Pacific Emerging Market Banks Outlook 2026.”

Risks are potentially highest in China, Thailand, the Philippines, Mongolia, and India, Fitch Ratings said.

Households and smaller businesses in emerging markets typically have thinner buffers and less financial flexibility, it added.

Amongst markets, China faces stress in these two segments on the back of ongoing challenging conditions in its property market.

China’s banking sector already saw new loans drop by 82.9% in October, due to weak household demand.

Meanwhile, in Thailand, banks have built buffers against elevated NPL ratios, Fitch said.

“A sustainable improvement in new NPL formation could support revising the sector outlook to ‘neutral’,” it added.

Thai banks are expected to prioritize asset quality and clean loan portfolios in 2026.

Advertise

Advertise