In Focus

How can Indian lenders balance loan growth and risk?

How can Indian lenders balance loan growth and risk?

Reforms could help improve efficiency, especially of state banks.

Big borrower default could wipe out a year of SEA bank earnings: S&P

Brunei, the Philippines, and Thailand are the most exposed to loan concertation risk.

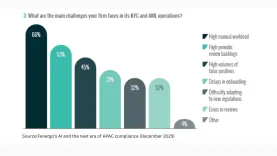

Half of APAC banks hit KYC backlog as manual systems fail

In Singapore, nine institutions were fined a combined $21m for anti-money laundering failures.

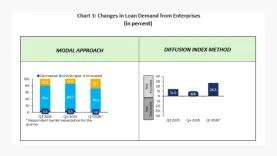

Indonesia loan demand stagnates as MSME and consumption slumps

Underlying demand for loans remains uneven although liquidity will be abundant, analyst said.

Digital payments clock 13% growth as physical cards retreat

Super-apps reduce dependency on traditional products by bundling diverse financial tools.

India's public banks must cut branches to hit 'world-leading' goal: S&P

Indian PSBs are inefficient due to underutilised and low-yielding branches, an analyst said.

Only 1 in 10 banks see AI returns despite $97b spend by 2027

Data fragmentation and governance uncertainty plague most AI adoptions.

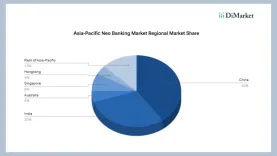

APAC neobanking hits $261b in 2025 as mobile use rises

China and India account for 70% of regional market share.

Payroll drives rural Indonesia banking uptake as digital banks fail to sway users

Digital banks are known but users said there is no difference in app experience.

Korean regulators hit 5 banks with record $1.38b in ELS penalties

Kookmin Bank will face the highest penalty if based on sales amount, the report said.

Steady loan outlook erodes as Philippine banks brace for Q1 squeeze

Banks expecting a flat borrowing appetite fell significantly from a previous high of 80.7%.

Vietnam banks face whiplash as fast lending fuels asset price risks

Credit growth target is 15% in 2026, but banks can be hurt if prices correct.

Malaysia credit growth eases to 5.3% as business loans cool

The banking system’s liquidity coverage ratio rose to 154.8% during the month.

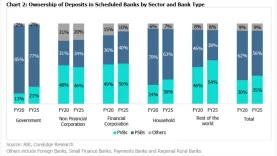

Indian public bank deposit share slumps to 56% as private rivals surge

Household savings held by private lenders climbed from 30% in 2020 to 35% by 2025.

Taiwan bank loan growth to hit high single digits on US pact

Increased overseas investments and corporate credit demand will lift loas.

OCBC and UOB to reverse year-long NIM slide in Q4

DBS Group Research forecasta a quarter-on-quarter margin improvement for two of the big three.

Greater Bay Area loan access index sinks to 48.7 as recovery reverses

Quarterly business confidence data shows lending conditions falling back into contractionary territory.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership