In Focus

APAC fintech exits hit $8.8b in H2 2025 as Hong Kong IPOs rebound

APAC fintech exits hit $8.8b in H2 2025 as Hong Kong IPOs rebound

In contrast, IPO activity in Australia was “dry”, said KPMG.

APAC fintech funding slumps 52% as VC investment craters

Total fintech funding reached $19.4b across 1,675 deals in 2022 before sliding.

How will mergers and crypto regulation reshape APAC fintech investment in H1?

Chinese fintechs will embrace "dual-market routes" to grow overseas.

APAC fintech deals drop to $9.3b in 2025 as private equity hits record low

Venture capital investment for fintechs in the region also fell to its lowest in a decade.

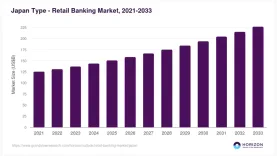

Japan retail banking to hit $227b by 2033

Market revenue stood at $143.7b in 2024 with 5.2% annual growth projected.

Indonesia’s Islamic loans to grow 10% but banks capped at 8% market share

Bank Syariah Indonesia (Persero) is likely to remain dominant.

Singapore card payments hit $119.6b in 2025 on SME push and contactless cards

Credit and charge cards made up two-thirds of the value.

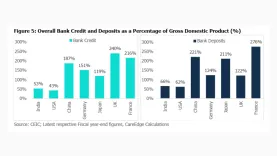

How India’s 53% credit-to-GDP ratio exposes a lending gap

Formal borrowing is expanding but still trails the scale of domestic economic activity.

Vietnam banks face credit split as quota phaseout looms and Basel III rolls out

Weaker, capital-constrained banks may struggle to meet regulatory changes.

Malaysia payments flip non-cash as e-wallet usage jumps 14%

Online bank transfers also gained whilst debit and credit cards ranked last amongst users.

How can Indian lenders balance loan growth and risk?

Reforms could help improve efficiency, especially of state banks.

Big borrower default could wipe out a year of SEA bank earnings: S&P

Brunei, the Philippines, and Thailand are the most exposed to loan concertation risk.

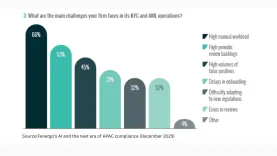

Half of APAC banks hit KYC backlog as manual systems fail

In Singapore, nine institutions were fined a combined $21m for anti-money laundering failures.

Indonesia loan demand stagnates as MSME and consumption slumps

Underlying demand for loans remains uneven although liquidity will be abundant, analyst said.

Digital payments clock 13% growth as physical cards retreat

Super-apps reduce dependency on traditional products by bundling diverse financial tools.

India's public banks must cut branches to hit 'world-leading' goal: S&P

Indian PSBs are inefficient due to underutilised and low-yielding branches, an analyst said.

Only 1 in 10 banks see AI returns despite $97b spend by 2027

Data fragmentation and governance uncertainty plague most AI adoptions.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision