Sibos 2018: China and Australia put APAC on the map in global fintech league

Three of the top five in KPMG's Fintech100 were nabbed by Chinese firms.

The unrelenting surge of Chinese fintech companies have cemented Asia’s position on the map for innovative financial solutions as the country’s payment and insurance titans dominate four of the top ten in KPMG’s Fintech100 rankings.

Chinese tech titans, Ant Financial which holds the title as the world’s largest third-party payments platform nabbed the first place followed by JD Finance. “There’s a lot of big Chinese fintech firms that were spin out from the parent companies - we’re seeing a lot of that this year. There’s been a huge amount of listing and IPOs for what used to be the financial services parts of Baidu or JD,” Anton Ruddenklau, global co-leader, fintech at KPMG told Asian Banking & Finance.

Also read: China's payment giants try to conquer Asia's banking scene

Singaporean ride-hailing firm Grab nabbed third place as it works on bringing its group payments, rewards and loyalty, agent network and financial services under one umbrella whilst short-term loan and investment service solution provider Du Xiaoman Financial seal the top four.

These four leading companies have all raised over $1b in the last 12 months; Ant Financial, JD Finance, Grab and Du Xiaomon Financial raised $14.5b, $2B, $2B and US$1.9b respectively.

On a regional basis, APAC continues to make its presence known with 37 companies on the region making it to list, up from 31 in 2017. Vietnam and Thailand were also included for the first time whilst Australian companies also performed strongly as AfterPay Touch and Airwallex made the land down under proud.

Bigtech companies like Google, Microsoft and Facebook are also increasingly forging closer ties with fintech. “The hyperscales themselves...are all building on ecosystem partnerships with the fintech so it’s not just fintech with a bank or insurance - so it’s fintech with one of the hyperscales. Big tech firms [tying up with] little fintech,” added Ruddenklau.

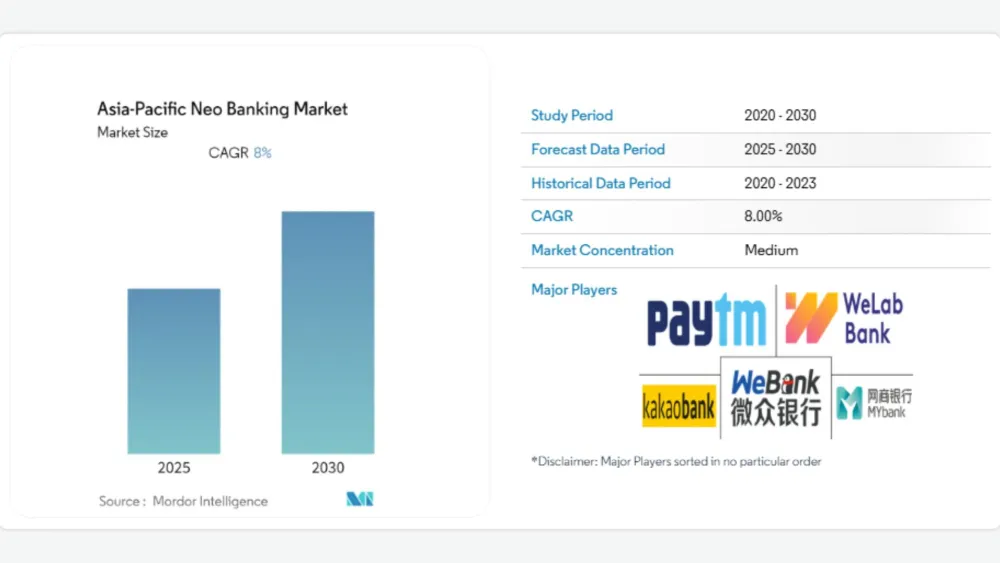

Payments and transaction companies ended up dominating after snapping up 34 places in the global rankings although lending companies also made their mark with 21 places under their belt. There were 14 wealth companies, 12 insurance companies, 10 neo-banks, 5 “multi” companies with diversified products and service line and 5 other companies which dabble in regtech and data analytics.

A collaborative effort between fintech VC investment H2 Ventures and KPMG, the Fintech100 report assess a fintech’s strength based on average annual capital raised, rate of recent capital raising, geographic diversity, sectoral diversity and x-factor.

Sibos is an annual banking and finance conference organised by the Society for Worldwide Interbank Financial Telecommunication (SWIFT). Elisha Yamzon of Asian Banking & Finance will be present at the four-day event from October 22-25. For editorial opportunities, kindly send an email to [email protected]. For advertising opportunities, kindly send an email to [email protected].

Advertise

Advertise