Who's winning in ASEAN's cashless race?

According to Standard Chartered, cash and cheques still reign supreme although evolving customer expectations are prompting incumbents to rethink of more efficient ways to handle transactions.

The availability of instant payments systems around the world has transformed the payments landscape and customer behaviour. Today, consumers, merchants, corporates, and financial institutions can make P2P, C2B, and B2C payments at the drop of a hat. As consumers and corporates expect faster settlement time, instant notifications, and automated consolidated reporting, their attitude towards traditional payment methods such as cheques, credit, debit, prepaid, and other e-payments will change, according to a report by Standard Chartered.

Instant payments systems offer an instantaneous, 24/7, interbank electronic fund transfer service that can be initiated through one of many channels - smartphones, tablets, digital wallets, and the existing web internet banking platforms. When a real-time payment request is initiated, an interbank account-to-account fund transfer is initiated and a transaction notification is posted instantaneously.

Real-time payments also enhance visibility throughout the payment process. All parties involved, including financial institutions, merchants, corporates, and consumers, can benefit from better cash management. Improved liquidity can in turn help corporates better manage their day-to-day operations. This makes a big difference for companies with long settlement cycles, and create a positive impact on their cash flow and Days sales outstanding (DSOs). The implementation of instant payments across most markets in ASEAN makes fund transfers faster, simpler, and more efficient. Instant payments clearing infrastructure is fast becoming the base for a number of innovative use cases across industries.

Payments

‘Just-in-time’ payments: The ability to make payments instantly simplifies payment processes. For instance, there is neither a cut-off time nor the need to build clearing time into payment schedules. Just as many corporations adopt ‘just-in-time’ supply chains, this solution can also now be applied to payment processes, working capital enhancements, more-precise funding, costs reduction and maintenance of facility headroom. These all significantly improve the efficiency of supply chains.

Supplier reach: To be able to pay in real-time, companies can access a wider supplier base without incurring additional supplier risk.

Customer service: Companies can provide a more responsive service to customers, including faster refunds, incentive payments, or insurance pay-outs.

Collections.

Fewer debtors and enhanced working capital: Real-time payments can make credit collection processes more dynamic and effective, shorten collection cycles, and facilitate faster collections (including disputed cases after they are resolved). This process enhances working capital by reducing funding costs and increasing investment returns.

New business models: One of the biggest advantages of real-time collections is the ability to develop and engage in new digital business models to access a wider customer base without taking on additional credit risks from customers.

Lower transaction costs and potential higher sales: Compared to credit card payments, real-time collections generally incur a much lower cost per transaction. On top of that, being able to collect funds faster, credit lines can be released faster to drive more sales.

Cash digitisation: Is cash still king?

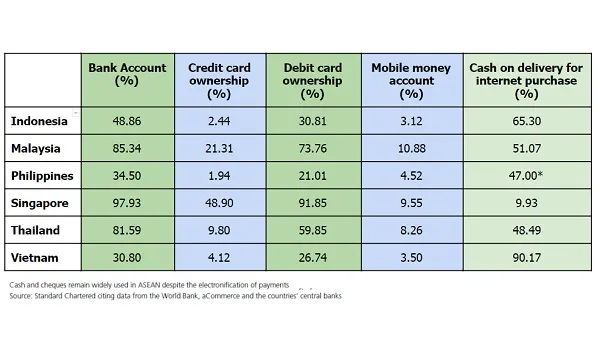

Although there is a rise in alternative electronic means of payments in the region, cash still dominates. Cash usage accounts for more than 70% of transactions each in the Philippines and Indonesia, and 43% in Singapore. Whilst the region may not be turning cashless at the snap of a finger, technology can help deliver features to attract consumers to embrace digital channels.

Apart from Singapore that holds a ‘stand out’ position in the Digital Evolution Index 2017 by Tufts University and Mastercard, the more traditional means of banking and payments remain more popular for the rest of ASEAN. Whilst the penetration of bank accounts has improved numbers in some countries, card penetration is relatively low (<50%). And in most of ASEAN, the preferred way to pay for online purchases is cash on delivery.

Other than cash, cheque payments remain widely used in some ASEAN countries. Cheque usage in the Philippines and Thailand has remained relatively stable even as its use has decreased in Indonesia by 32% in the past five years. In Singapore and Malaysia, governments have made the reduction of cheque usage a priority in their effort to move towards a digital economy. Singapore aims to lower the use of cheques to 15% in 2020 and be

cheque-free by 2025, while Malaysia targets to reduce its cheque volume to 100 million per year by 2020, half the usage in 2012.

Markets like Indonesia are also trying to move away from cheque issuances. Bank Indonesia unveiled a direct debit feature in their national clearing system in 2016, and is in discussions to launch additional payment options to provide digital alternatives to cheque/bilyet giro.

Digitising cash and cheque collections

Whilst efforts are being made to move from paper to electronic, cash and cheques remain the status quo and will not be eliminated overnight. As consumers and corporates become more receptive towards electronic payments, technology is leveraged to provide more innovative solutions to make cash and cheque handling more efficient.

a. Cash deposit machines

The use of cash deposit machines is one way of balancing consumers’ demands for a prompt and seamless service and corporates’ objectives to become more efficient. Many FMCGs, distributors, logistics, and retailers still handle many cash collections and face challenges such as delayed funds realisation and reconciliation as well as inherent operational risks. The availability of cash deposit machines provides these companies with a more efficient process of collecting payments.

Through cash deposit machines, we bring the “bank teller” to our clients’ office and enable companies to receive real-time updates of the amount deposited on the same day. While these machines do not represent new technology, the real-time connectivity with feeds into the Corporate Enterprise Resource Planning (ERP) platforms leverages new-age technology such as API (Application Programming Interface) banking.

b. Remote cheque scanning solution

The remote cheque scanning solution is supported by the electronic image clearing processes at the clearing house, an operation approved by regulators. This eliminates the need for physical cheques to be transported from presenting banks to paying banks. Instead, cheques are picked up by the vendor from the clients’ premises, scanned, and sent for clearing on the same day, reducing the clearing time from 3-5 days to only one day. Within a few hours after the cheques are scanned, bank clients are alerted of the cheque deposit. After the credit facility is approved, funds are immediately credited into the clients’ bank accounts.

Mobile wallets – the new and rising payments method

According to a survey by PayPal Asia Research on Digital Payments in 2017, familiarity with e-wallets/mobile wallets in Asia is around 49%, with the highest awareness in China (around 83%). The success of mobile wallets acceptance in China is driven by its mobile-first consumer mindset, innovative social commerce model, and a robust and trusted digital payments infrastructure.

In India, the government’s decision to demonetise Rs. 500 and Rs. 1,000 notes in November 2016 led to the rapid adoption of mobile wallets. One year after the demonetisation, digital payments transactions rose to 53% (by value) and 33% (by volume). Statistics from the Reserve Bank of India shows that UPI (UnifiedPayments Interface) grew at a compounded monthly rate of over 100% within six months of the demonetisation move.

Different types of e-wallets have emerged, targeting different segments to serve different purposes.

Enhance convenience for customers in a closed-loop ecosystem – Some companies create their own close loop e-wallets that allow their customers to make electronic payments, view past transactions, and collect rewards for transactions or the exclusive use of their products and services.

Cater to consumers’ new lifestyles – New tech companies are creating e-wallets that first connect to their main business and subsequently expand to include other merchants. AirAsia’s Bigpay, Singapore-based Grabpay, Indonesia’s Gopay by Go-jek are some examples. While these payments gateways let users pay for their transportation services, they also partner with other merchants to provide additional payments options to the users and increase the usage of their e-wallets. Banks have also capitalised on the e-wallet technology by making it easier for customers to conduct transactions at smaller stores, such as enabling customers to make payments at smaller shops with the scanning of a QR code. While some banks mandate their customers to top up their e-wallets, others allow digital payments to be made directly from the customers’ bank accounts.

Increased cross-border activities, from travel to payments, have encouraged operators to enable regional mobile financial services. Alipay and WeChat Pay entered the market to accommodate their Chinese users travelling to ASEAN. With the aim of unifying Asia’s fragmented payments scene, Singapore’s Singtel in October 2018 partnered with Thai telecommunications operator AIS and Kasikorn Bank to form an alliance named ‘VIA’, a partnership claimed to be Asia’s first cross-border mobile payments tie-up. This offers QR code-based mobile payments for users of Singtel Dash, AIS Global Pay and Rabbit Line Pay e-wallets. Payments can be made at VIAapproved merchants located in Singapore and Thailand.

Improve financial inclusion by giving access to the unbanked and those located in remote areas – With the network infrastructure that spans across countries, telecommunications companies have played a more active role in reaching the unbanked and those located in remote areas. Their services began with a simple feature of allowing members to top up their e-wallets for the purpose of transferring funds to other members. This was followed by other capabilities such as bill payments, movie ticket purchases, payments via QR codes, as in the case of the Philippines’ GCash and PayMaya.

What it means for corporate treasurers and consumers

Not only is digitisation changing the way businesses interact with their customers, suppliers, and markets, digital innovation is reshaping the day-to-day operations of corporate treasury and how treasurers interact with financial markets. Treasurers need to embrace technology to drive a more efficient treasury function and become a value-added adviser to their business. Instant payments have the potential to enhance corporate treasuries’ ability to optimise liquidity management.

From a payments perspective, instant payments offer corporate treasury the following capabilities:

• Fund and pay “just-in-time” instead of 2-3 days in advance, as is often the case today. This will potentially improve working capital metrics

• Pay suppliers more quickly and take advantage of early-payment discounts under the dynamic discounting arrangements

• Ensure completion of urgent and time-sensitive payments, with immediate rejection notices

• Generate accurate liquidity forecasting, with no cash in transit or trapped in clearing accounts

From a collections perspective:

• Collect from customers more quickly with faster cash reconciliation – this will enable a faster release of goods to customers and reduce inventory or in-transit costs

• Refresh credit limits sooner, allowing distributors customers to place more orders

• Leverage the captured liquidity to recycle into the business or generate higher returns

Corporate treasuries have to adopt new technologies to manage liquidity both overnight and over the weekends. Critical to achieving this is real-time cash visibility via an API that instantly advises of a credit/debit to the account. Similarly, Robotic Process Automation (RPA) tools will need to be developed to operate around the clock, and thus enabling a “24hr Treasury” function.

The various digitisation initiatives are creating significant opportunities for corporate treasurers to increase operational efficiency across the domains of cash and liquidity management, optimise working capital, and strengthen the risk and controls environment. Corporate treasuries will need to undertake their own transformation to embrace and leverage new technologies and ultimately align with the evolving needs of the business and the markets in which they operate. From Standard Chartered: Cash Digitisation in ASEAN

Advertise

Advertise