Why the worst may be over for China's credit crunch

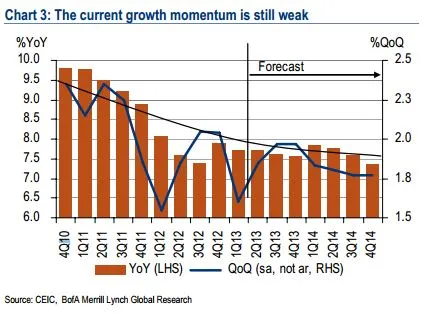

Current growth rate is quite close to the floor.

First, to be sure, BBVA notes that although new the leaders have no intention to achieve higher GDP growth, the current growth rate is quite close to the floor that the new leaders have indicated they will tolerate.

Here's more from BBVA:

Since Shibor rates that are too high for an extended period and an interbank credit crunch could lead to serious distortions of the financial markets that are set for slow growth, it is unlikely that the PBoC will allow the credit crunch to persist for any length of time.

Second, although we recognize that some financial deregulation and innovation in the past couple of years have created new risks, including the much talked about “shadow banking”, we don’t think China’s “shadow banking” and debt levels will lead to a nationwide financial crisis or an economic hard landing any time soon.

Advertise

Advertise