Tight lending rules limit Thai SME credit access

Strict bank requirements and economic instability restrict SMEs' funding options.

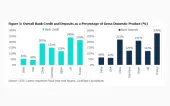

Access to credit remains a significant hurdle for small and medium enterprises (SMEs) in Thailand, with loans shrinking by 5.1% year-on-year. Less than half of Thai SMEs can obtain bank loans, limiting their ability to sustain and grow their businesses.

Vikas Jain, Country Head of Funding Societies, highlighted the structural barriers that prevent SMEs from securing financing. "For Thailand, SMEs are very, very important. They contribute to about 99% of the businesses, about 80% of the jobs, but only less than half of them are able to access formal credit," Jain said.

Among the key challenges are inadequate documentation and the lack of collateral, both of which are typically required by traditional financial institutions. "They also have fluctuations in their business which impact their revenue and thereby make them ineligible for loans with the more traditional institutions," Jain explained.

Seasonal businesses, in particular, struggle due to inconsistent income and revenue streams. Additionally, economic fluctuations have led financial institutions to tighten lending norms.

"Businesses have not been performing as well as they were doing previously, and delinquencies are rising across the board, with banks, with traditional financial institutions, with fintech lenders as well," Jain observed.

To address these concerns, fintech lenders are leveraging alternative data and dynamic credit scoring models. Close monitoring of SMEs' repayment behavior and business performance is also crucial. "Fintech lenders need to have a scoring model which is flexible enough to incorporate these changes, as well as sudden shocks in the economy and specific industries," Jain explained.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership