New Zealand seeks feedback on liquidity framework and new CLF

It proposes changes for open market operations, such as reducing the max tenor.

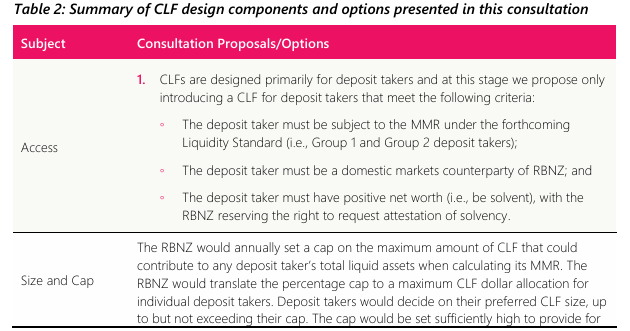

The Reserve Bank of New Zealand (RBNZ) has launched a consultation to review the country’s current liquidity management framework, including the establishment of a committed liquidity facility (CLF).

New Zealand’s central bank in particular is seeking feedback on key design considerations for open market operations (OMOs) and the proposed CLF, closing on 31 October 2025, according to a statement on its website.

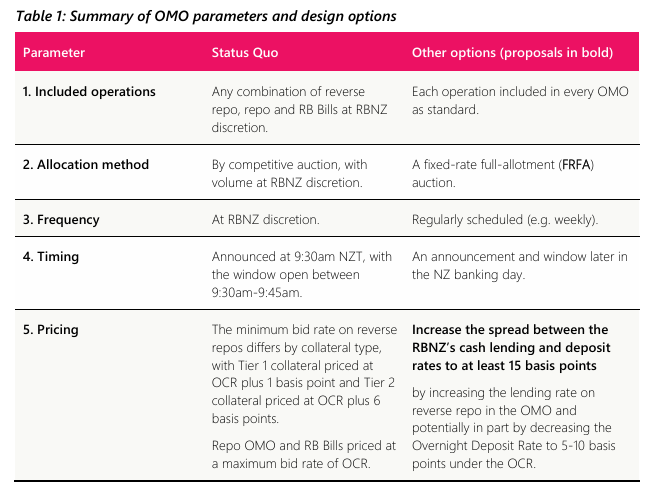

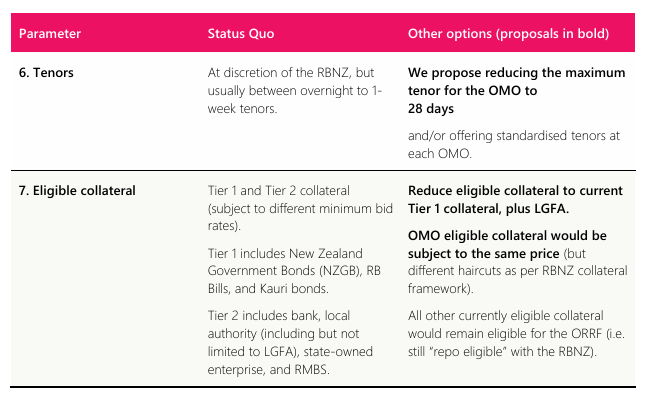

Proposed changes to the OMO include increasing the spread between RBNZ’s cash lending and deposit rates to at least 15 basis points; reducing the maximum tenor of the OMO to 28 days; reducing eligible collateral to current Tier 1 collateral; and the OMO eligible collateral would be subject to the same price.

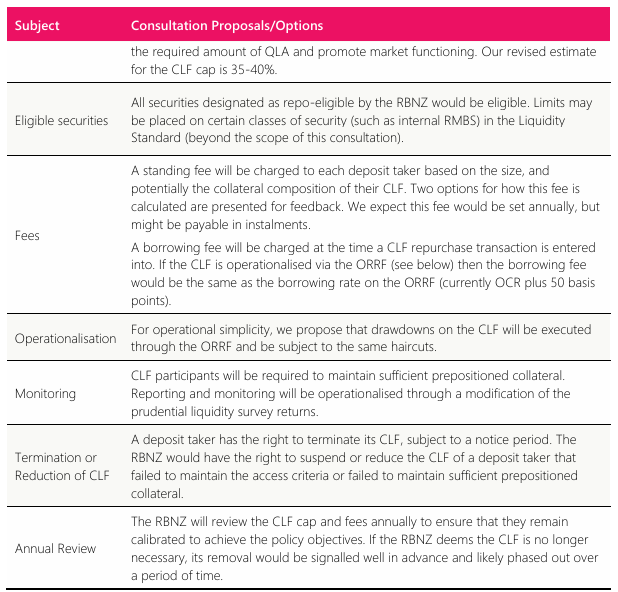

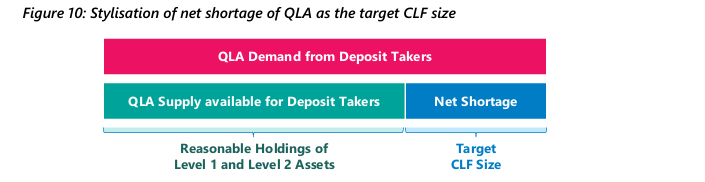

Meanwhile, the RBNZ said that at this juncture, it is focused on establishing the CLF solely for deposit takers to provide liquidity for their prudential liquidity requirements. The size and cap of the CLF for the system is proposed to cover the shortfall between the supply and demand of qualifying liquid assets (QLA).

Supply of QLA is the amount of Level 1 and Level 2 liquid assets that could reasonably be held by deposit takers. Demand for QLA is the amount required by the deposit takers to meet liquidity requirements including reasonable buffers over the regulatory minimum, as defined by the central bank.

Advertise

Advertise