Here are five ways banks can use agentic AI

Agentic AI helped free up 10% more time for client interactions, McKinsey reported.

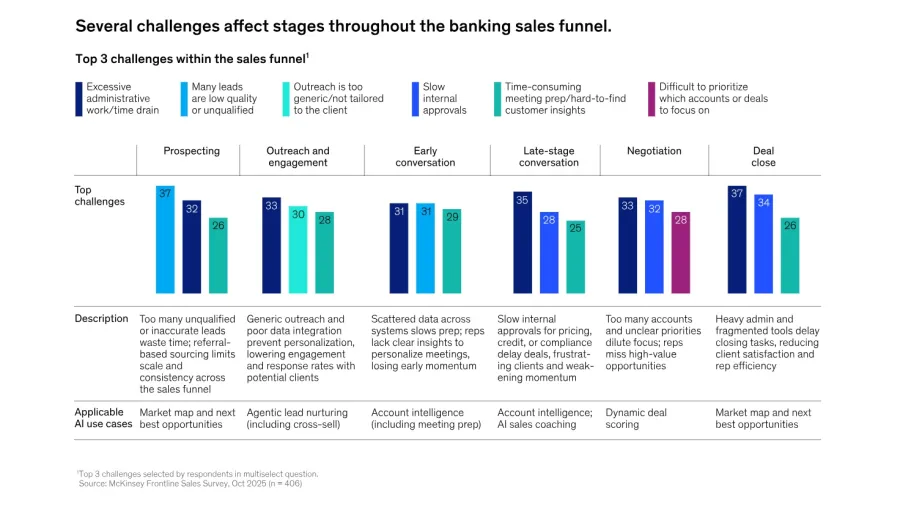

Banks believe that agentic artificial intelligence (AI) can help their agents find new clients faster, identify the best prospective clients, aggregate data faster, make faster pricing decisions, and help in coaching staff.

Banks that use AI-driven market maps report a 30% growth in the pipeline of new clients, and 10% higher revenues, according to a report by McKinsey & Co. released on 2 December 2025.

“Instead of spending hours cold-calling, bankers receive curated, ranked prospects that offer a higher chance of conversion,” The management consulting firm wrote in the report, “Agentic AI is here. Is your bank’s frontline team ready?”

The poll, which surveyed 400 bankers, relationship managers, and sales leaders in banks across US and Canada, found that many see AI useful in nurturing leads— replying to inquiries, sending personalised content, and scheduling meetings, amongst others— as well as compiling data to make account plans.

In the APAC region, several banks have signalled their interest in agentic AI. Japanese megabank SMBC has set up an agentic AI startup in Singapore to explore use cases faster. UOB teamed up with Accenture earlier this year for AI adoption and integration, including agentic AI.

Early pilots of agentic AI acting as virtual relationship managers (RM) helped to increase qualified leads two or threefold, McKinsey found.

For account planning and meeting preparation, banks saw preparation time fall by about 25%, freeing up 10% more time for client interactions, the study found.

However, there is still the question of trust when it comes to agentic AI adoption. As more consumer interactions are mediated by AI, banks risk losing control over how their information is represented and interpreted, Roy Fielding, Senior Principal Scientist at Adobe, told Asian Banking & Finance on the sidelines of the Singapore Fintech Festival 2025.

DBS CEO Tan Su Shan said during SFF 2025 that whilst technology is transforming operations, trust remains the foundation of a sustainable financial institution.

Advertise

Advertise