Why Singapore's 30-40% drop in mortgage approvals is bad news for UOB

Impact will be seen in 2H14.

According to DBS, expect NIM to remain stable from here with possible upside over time. Loan growth should end the year in the low-to-mid teens but moderate in 2014. Mortgage approvals have declined 30-40% y-o-y and impact on mortgage growth is likely to be seen in 2H14.

Here's more:

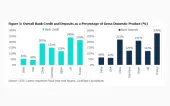

UOB’s exposure to mortgages as at 3Q13 is the highest among peers, at 28% of total loans (OCBC: 25%; DBS: 20%). Separately, we do not expect asset quality issues to crop up. Credit cost of 30bps remains the bank’s guidance.

Regional growth remains in focus. UOB continues to pursue its regionalisation agenda. We note that its regional corporate banking strategy has gained traction, though in a different manner from its peers which have largely tapped on trade finance.

UOB has clearly said previously that this strategy may compromise margins but fee income will make up for it. Although Indonesia and Thailand economies remain vulnerable in the short term, UOB maintains its position to grow its regional franchise.

UOB continues to participate in growth segments in Malaysia, particularly in the Iskandar region. On M&A, management cited that they would consider attractive propositions if the pricing is right.

Advertise

Advertise