APAC

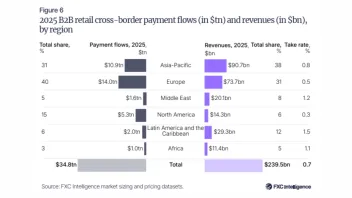

APAC leads B2B cross-border payments revenue share at 38%

APAC leads B2B cross-border payments revenue share at 38%

The region’s share was equivalent to $90.7b. and was followed by Europe with $73.7b.

8 hours ago

BofA’s Winnie Chen charts real-time payment path

Companies want simplicity and certainty as they move funds across borders.

2 days ago

SWIFT rolls out new framework for retail payments

A group of 25 banks will go live with it by the end of June.

2 days ago

Societe Generale names Ken Tung as Asia head of its healthcare industry group

Tung will continue to serve as APAC head of financial sponsors coverage.

2 days ago

Emerging market banks’ loan growth hit 12% in H1 2025

Emerging market banks’ loan growth hit 12% in H1 2025

2 days ago

From compliance to personalisation: Advancing banking & financial services experience

Experts explored how banks and financial services can deliver seamless, compliant, and personalised customer experiences.

3 days ago

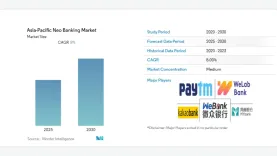

Neobanking to grow 30.46% CAGR in APAC

Fintech value projected to reach $348.1b by 2031 as online banking platforms expand.

3 days ago

Stablecoin payment volumes double to $390b as Asia claims 60% share

Majority of activity is in Singapore, Hong Kong, and Japan, according to McKinsey and Artemis Analytics.

5 days ago

APAC neo banks face trust barrier despite 8% CAGR

Mordor Intelligence sees expansion through 2030 even as rural access gaps slow uptake.

5 days ago

Societe Generale name Selina Cheung as head of ECM in APAC

Cheung was previously head of unified global banking APAC at UBS.

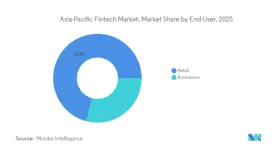

Retail holds 71% of APAC fintech market in 2025

Enterprise users to expand at 25.47% annually through 2031.

ISO 20022 and agentic AI to drive payment unification in 2026

But financial institutions (FIs) and tech providers must integrate new real-time systems with legacy rails.

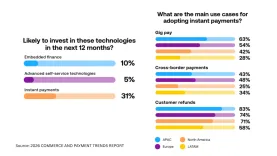

4 in 10 APAC firms prefer instant payments for cross border transfers

72% of instant payment use is currently tied to standard customer purchases.

Citi forms AI Infrastructure Banking team to tap $3t financing opportunity

The team aims to provide debt financing to fund data centres and other infra capacity.

Digital wallets, agentic AI to speed up payments

The focus is on agentic systems that can act on behalf of users.

APAC private banking to grow 9.43% CAGR

The market is forecast to expand from $44.3b in 2025 to $76.05b by 2031.

How will agentic AI change online payments?

It’s unclear who’s liable if it over‑orders or pays the wrong merchant.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026