Singapore

DBS and TenPay Global launches zero-fee transfers to Weixin Pay wallets

DBS and TenPay Global launches zero-fee transfers to Weixin Pay wallets

The bank connects customers to mainland China wallets.

1 day ago

Standard Chartered launches ESG-linked cash account

Enhanced interest rates apply when sustainability targets are met.

1 day ago

OCBC new investors triple as bank braces for 2026 gold, silver uptick

The bank sees sustained growth on the back of industrial use and recent price rallies.

2 days ago

DBS pilots Visa Intelligent Commerce for agent-initiated payments

Pilot tests AI agents completing everyday purchases using issuer-controlled payment flows.

4 days ago

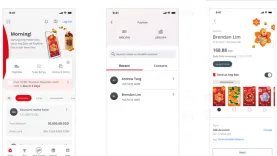

MariBank links remittances to Weixin Pay via TenPay Global

Users can send salaries and savings via MariBank Overseas Transfers.

DBS to focus on tech resilience and grow fee income in 2026: analyst

The bank should balance increased distributions and M&As, an analyst said.

OCBC enables Weixin Pay QR payments via bank app

Customers will see rates in real-time before making a transaction.

HSBC Singapore names Suzy White to its board

White is the current group COO of HSBC.

Singapore card payments hit $119.6b in 2025 on SME push and contactless cards

Credit and charge cards made up two-thirds of the value.

DBS' net profit down 3% to $11b in 2025

Its net profit fell by 3%.

Standard Chartered launches SC Shop and Earn cashback on SC Mobile

Priorty Private and Priorty Banking clients can earn up to 6.9% cashback on Agoda and Expedia.

Singaporeans’ travel spend shift to Asia for snow and healthcare

They’re traveling to Thailand and South Korea for medical services.

UOB set for growth as DBS, OCBC earnings hold steady: report

The sector benefited from dividend potential and provision write-backs.

E-ang bao use jumps nearly 50% in 2025 as seniors ditch red packets: OCBC

Nearly 8 in 10 seniors were first-time e-ang bao senders, OCBC said.

OCBC and UOB to reverse year-long NIM slide in Q4

DBS Group Research forecasta a quarter-on-quarter margin improvement for two of the big three.

HitPay enables SG merchants to accept overseas QR payments

SG merchants can now accept regional e-wallets through a single code

Fintech Fingular secures $10m credit line for Malaysia expansion

The funding will also be used to strengthen operational capacity.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership