Malaysia

CIMB’s FY2026 target achievable: CGSI

AEON Bank rolls out 11 types of Zakat payments in digital app

It worked with Tulus Digital to enable the payments.

9 hours ago

Malaysia's corporate lending slumps to 3.8% as 24-month credit gains unwind

Total credit, including bonds, still accelerated to 5.5% year on year by the end of January 2026.

16 hours ago

Malaysia industry loan growth slows to 4.7% in January

Lending for commercial complexes shrunk for the 14th straight month.

2 days ago

Malaysian bank lending rises 5% on more business loans

Business loans rose 4% whilst household loans grew 5.6%.

3 days ago

Public Bank’s Q4 profit up 2% QoQ as NIM begins recovery

Recovery is expected to gain traction in Q1 2026, said UOB Kay Hian.

3 days ago

CIMB net profit edges up 1.7% to $2.03b in 2025

Profit before tax increased to 2.7%.

3 days ago

CIMB ties up with Ant Int’l to push digital treasury and liquidity framework

They will use Ant’s blockchain-based treasury management solution.

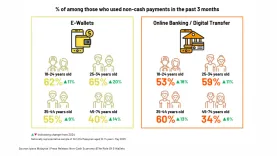

E-wallet use jumps to 65% amongst Malaysia’s 25- to 34-year-olds

Older users logged a 14% rise year on year but still trail younger groups on this method.

Maybank pilots tokenised ringgit for cross-border payments

The bank aims to pioneer a range of tokenised assets, from Islamic finance to wealth products.

Hong Leong Bank rebrands wealth segment as HLB Priority and revamps centres

Modernisation of priority centres is scheduled to be completed around March 2026.

Malaysia payments flip non-cash as e-wallet usage jumps 14%

Online bank transfers also gained whilst debit and credit cards ranked last amongst users.

Malaysian bank loan growth to stabilise at 4.5% to 5.5% in 2026

The 2025 slowdown to 4.8% seen as normalisation after 2024’s 5.5% expansion.

Malaysia credit growth eases to 5.3% as business loans cool

The banking system’s liquidity coverage ratio rose to 154.8% during the month.

Precision Growth, AI Operations: Asian Banking & Finance and Insurance Asia Summit Heads to Kuala Lumpur

The event will feature insights from industry figures at AmMetLife, CIMB Trustee Group, Simon-Kucher, and Generali Insurance Malaysia Berhad.

Maybank targets 13%–14% ROE by 2030 under ROAR30 strategy

It aims for a NIM of over 2.05% and a cost-to-income ratio of not more than 47%.

Deutsche Bank Malaysia appoints first female chair, new non-executive director

The appointees bring expertise in finance, audit, risk, governance, policy.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026