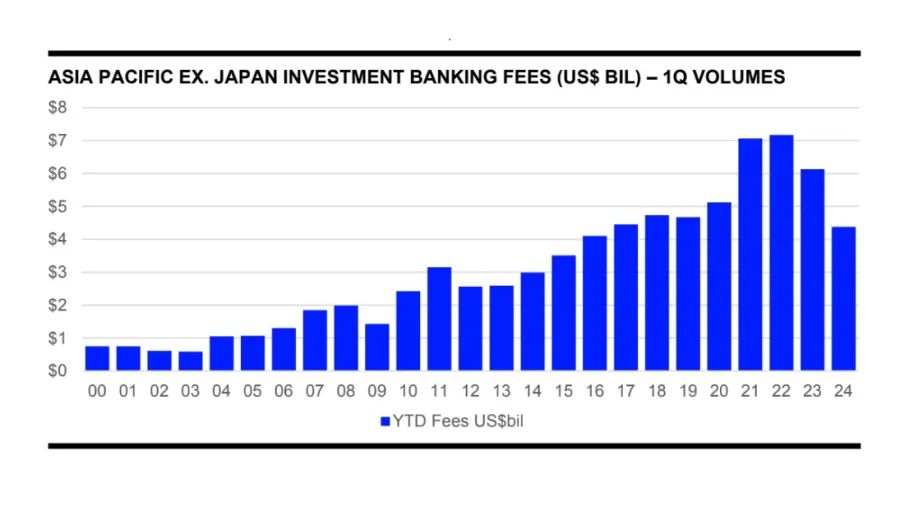

APAC ex Japan investment banking fees in Q1 falls to lowest level in 8 years

Equity capital market fees were halved, whilst debt capital market fees were static.

Investment banking activity in Asia Pacific is not off to a good start this 2024, with the region generating its lowest level of investment banking fees for a first quarter period since 2016.

An estimated $4.4b in investment banking fees were generated in APAC excluding Japan in Q1, down 29% compared to the same period last year, according to data from London Stock Exchange Group (LSEG) Data & Analytics.

ALSO READ: Chart of the Week: Singapore investment banking fees down 14% in Q1

The near-stagnant growth of debt capital market (DCM) fees and lower equity capital market (ECM) underwriting fees contributed to the decline.

ECM fees were halved to only $688.4m in Q1, 57% lower than a year ago. This is also the lowest period since 2013, LSEG Data & Analytics said.

DCM fees saw a marginal 1% growth from a year ago to $2.8b.

Syndicated lending fees are 46% lower from last year, at $523.6m.

There were also fewer M&A transactions so far, with estimated advisory fees from such falling 54% to $353.1m compared to a year ago.

ALSO READ: Japanese banks ‘less reluctant’ to finance hostile takeovers: report

Amongst banks, CITIC took the top position for overall investment banking fees in Asia Pacific, excluding Japan, with a total of $245.9m, accounting for 5.6% wallet share of the total APAC investment banking (IB) pool.

Globally, Asia Pacific ex. Japan fees accounted for 16% of the total fees in Q1, whilst European IB fees accounted for 25%.

Advertise

Advertise