Singapore investment banking fees down 2% to $796.12m

Advisory fees for completed M&A dropped 16.5%.

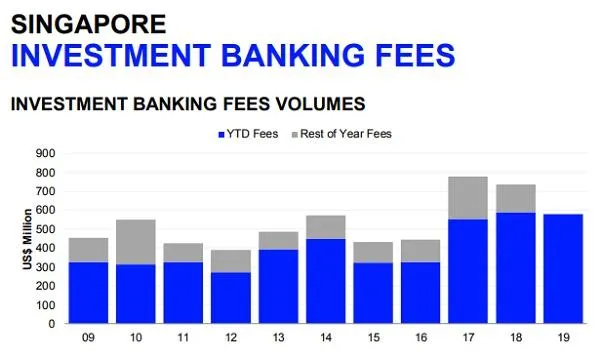

Investment banking fees in Singapore dipped 2% YoY to $796.12m (US$577.8m) in the first nine months of 2019, Refinitiv reported.

Also read: Singapore investment banking fees down 24.8% to $172.8m in Q1

Advisory fees for completed mergers and acquisitions (M&A) fell 16.5% to $211.91m (US$153.8m) after the record total from the same period in 2018, and syndicated lending fees dropped 15.2% to a three-year low of $191.52m (US$139m).

Underwriting fees in the equity capital markets (ECM) soared 60.2% to a six-year high of $196.89m (US$142.9m), whilst fees from debt capital markets (DCM) underwriting slipped 6.7% to $195.79m (US$142.1m).

M&A activity announced in the island declined 35.1% to $33.9m (US$24.6m) in Q3, but Singapore-involved M&A for the first nine months jumped 70.6% YoY to a record $121.66b (US$88.3b), capturing over half of the activity in Southeast Asia.

ECM proceeds surged 43.9% to $7.85b (US$5.7b), the best first nine months since 2013. Initial public offerings by companies in the country raised 130.3% more proceeds at $2.20b (US$1.6b), driven by offerings from REITs totalling $1.4b (US$1.4b).

On the other hand, primary bond offerings from Singapore-domiciled issuers dropped 18.4% to $35.55b (US$25.8b). Commanding 56.9% of the market, the Financials sector raised 26.9% lower at $20.25b (US$14.7b).

DBS Group Holdings clinched the most investment banking fees for the period with a total of $99.21m (US$72.0m), commanding 12.5% of the market. It topped the ECM underwriting rankings, capturing 17.9% of the market, followed by Morgan Stanley and Goldman Sachs with a 13.6% share each.

DBS Group also led the bonds underwriting rankings with a market share of 21.7%, followed by OCBC and HSBC Holdings PLC, which represented 10.9% and 9.7% respectively.

JP Morgan placed first in Singapore-involved announced M&As, with 34.2% market share, followed by Morgan Stanley with 33.1%, and Citi with 26.3%.

Advertise

Advertise