Which suburb in Australia leads in mortgage arrears?

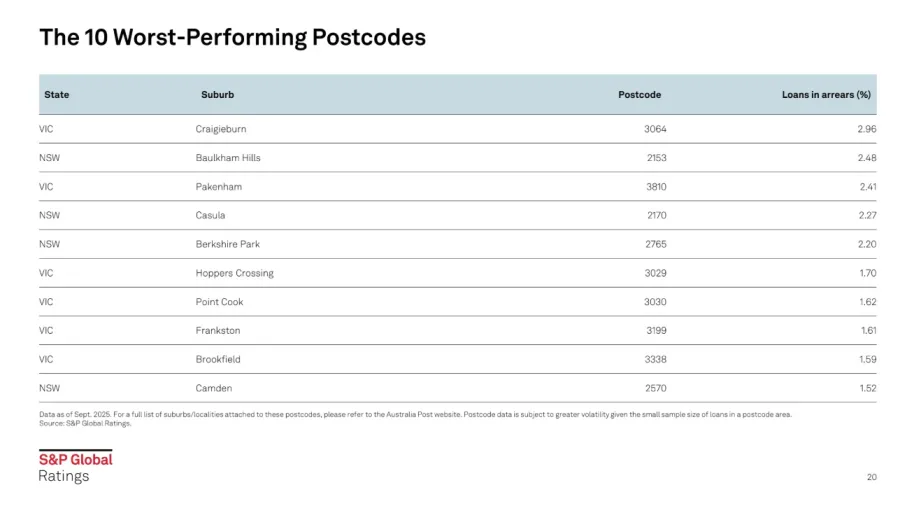

Victoria and New South Wales are the only states represented in the highest-arrears list.

The Craigieburn suburb in Victoria, Australia, has been named the worse performing postcode in terms of mortgage loan arrears, according to a study by S&P Global Ratings.

The suburb— with postcode 3064— has 2.96% of mortgage loans in arrears, the ratings agency said, based on data as of September 2025.

An arrear is a payment that remains unsettled past the due date; S&P measures arrears in this report for loans that are over 30 days overdue.

Baulkham Hills (2153) in New South Wales (NSW) and Pakenham (3810) in Victoria followed suit. The rest of the top 10 are all suburbs in NSW and Victoria.

NSW, Victoria, the Northern Territory and the Australian Capital Territory (ACT) logged the highest arrears. However, arrears in North Territories and the ACT region are declining, S&P said.

Investor participation is notably picking up, which will accelerate property price growth. This is likely to crowd out first-home owners, S&P said.

Over 1 in 3 Australians surveyed by Finder revealed that they have slashed personal spending in a bid to afford a home loan. Despite these efforts, over 1 in 3 (35%) of the survey respondents said they don’t think they’ll ever be able to afford their own home.

S&P Global Ratings however said that many households in Australia appear to be feeling more optimistic.

“The household savings ratio is declining as spending on recreation and culture ticks up, supported by improving wage growth and lower mortgage repayments,” the ratings agency said in its Q3 2025 report on Australian residential mortgage-backed securities (RMBS) published in November 2025.

Advertise

Advertise