Australian bank sees subdued credit demand

Rein in costs and cut jobs.

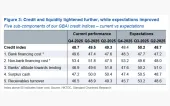

Australian banks have no recourse but to do this as credit expansion is now on its slowest.

This was brought about by the prefernce of customers prefer to save and a lack of opportunities that deter corporate investment.

Commonwealth Bank of Australia said it expected credit demand to remain subdued in the short term as global economic uncertainty hurts customer confidence.

"While I am optimistic about the medium- to long-term outlook for Australia, the local economic climate also remains uncertain," said Commonwealth Bank of Australia chairman David Turner.

"It's difficult to see the catalyst for alleviating the uncertainty which will continue to affect consumer and corporate confidence," he added.

Australia, among the few developed countries to avoid a recession during the global financial crisis, is coming under pressure as slowing Chinese growth weighs on its mining sector, which has so far helped to shield the economy.

For more.

Advertise

Advertise