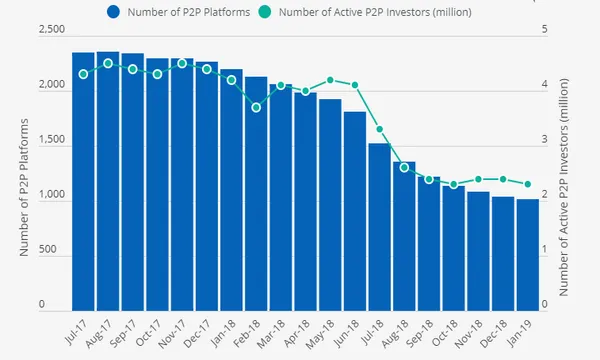

Chart of the Week: Chinese P2P players halved in 2018 amidst tougher regulations

Active P2P investors also fell 45.2% to 2.3 million.

The number of P2P lenders in China has decreased as the ongoing shadow banking crackdown continues to cull risky financial activities, Fitch Ratings said. From 2,194 operational P2P platforms in January 2018, 53.6% failed to survive, bringing down the numbers to 1,018 by January 2019.

The number of active P2P investors also went down to 2.3 million in January 2019. This represents a 45.2% decline compared to the 4.2 million active investors a year ago.

“China's peer-to-peer (P2P) lending industry will continue to shrink and consolidate as tighter regulation and weak investor sentiment drive out operators conducting the riskiest activities,” Fitch Ratings said. “New regulations will also require many platforms to reduce their reliance on retail investors, leading to a shift towards wholesale or institutional funding sources.”

Also read: China's shadow banking sector to shrink to half of GDP in 2019

Retail investors inject over 90% of funding for Chinese P2P lenders which is in contrast to other P2P markets that are predominantly wholesale-funded such as the US, Fitch noted.

China's P2P lending sector has generally weak asset quality with several leading platforms reporting loss rates of 7%-10%. Asset quality could deteriorate if tighter P2P lending rules reduce the refinancing options for borrowers who rely on multiple facilities to roll over their loans.

“Increased institutional funding could significantly improve the Chinese P2P sector's funding profile, but the availability of such funding is susceptible to regulatory actions across the system,” the firm explained.

Advertise

Advertise