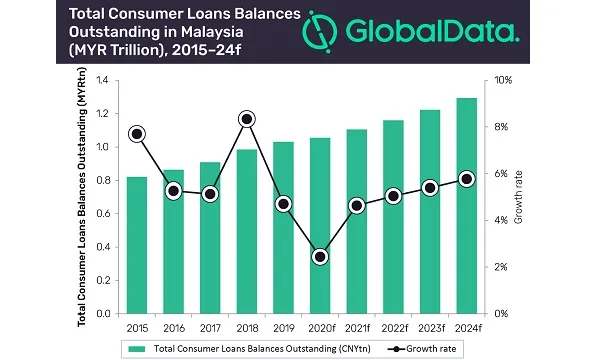

Chart of the Week: Malaysia's consumer loan growth to decelerate in 2020

There’s just little banks can do to encourage people to take out loans.

Consumer loan growth in Malaysia is expected to decelerate to a 2.4% expansion in 2020 after registering a compound annual growth rate (CAGR) of 5.9% between 2015 and 2019, as consumers cut down on large value purchases and adopt a wait-and-see approach, according to data from GlobalData’s global retail banking analytics report.

“New loan applications will also see a drop as consumers become more cautious about taking on additional liabilities due to economic uncertainty. Consumer spending is affected as wary consumers stay at home and cut down on large value purchases,” noted Shivani Gupta, senior banking and payment analyst at Global Data.

Mortgage loans, which account for the largest share of consumer loans in Malaysia with almost 60% share in 2019, are experiencing mounting pressure on supply and demand. Consequently, a wait-and-see approach is prevalent, as both buyers and sellers have become more vigilant amid the outbreak.

As a result, GlobalData revised its forecasts for mortgage balance growth to 2.2% for 2020, more than 5 percentage points (ppt) lower than the previous forecast of 7.9%.

The Malaysian central bank’s announcement of automatic six-month loan payment deferral for existing loans (including mortgages) will, however, provide some relief to individuals affected by the COVID-19 outbreak. However, this will not be enough to encourage consumers to take out new loans, noted Shivani.

Advertise

Advertise