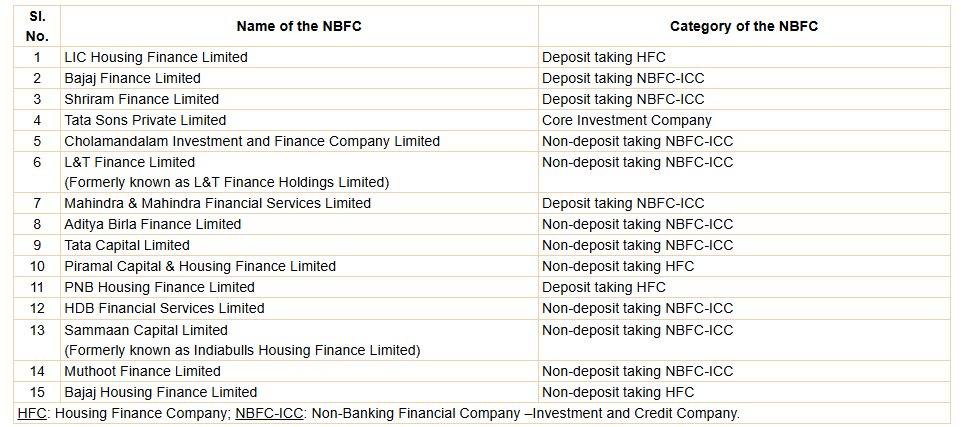

RBI names 15 NBFCs to upper layer

They are subject to enhanced regulatory requirements for a 5-year period.

The Reserve Bank of India (RBI) named 15 non-bank financial companies (NBFCs) to the “upper layer” under its Scale Based Regulation (SBR) regulatory framework for categorizing NBFCs.

NBFCs in the upper layer comprise of NBFCs specifically identified by the RBI as warranting enhanced regulatory requirement based on a set of parameters and scoring methodology. The top ten eligible NBFCs in terms of their asset size shall always reside in the upper layer.

Once an NBFC is classified as NBFC-UL, it shall be subject to enhanced regulatory requirement, at least for a period of five years from its classification in the layer, even if it does not meet the parametric criteria in the subsequent years.

Deposit-taking firms on the list are LIC Housing Finance, Bajaj Finance, Shriram Finance, Mahindra & Mahindra Financial Services, and PNB Housing Finance.

Tata Sons Private Limited is the sole core investment company on the list.

Piramal Enterprises Limited is not on the list due to ongoing reorganisation of business, despite qualifying for identification as NBFC-UL.

Tata Sons Private Limited’s inclusion on the list is “without prejudice to the outcome of its application for de-registration, which is under examination,” the central bank said.

Advertise

Advertise