ZA Bank unveils business loan for Global Payments merchants

The virtual bank examines credit health based on business activities, amongst others.

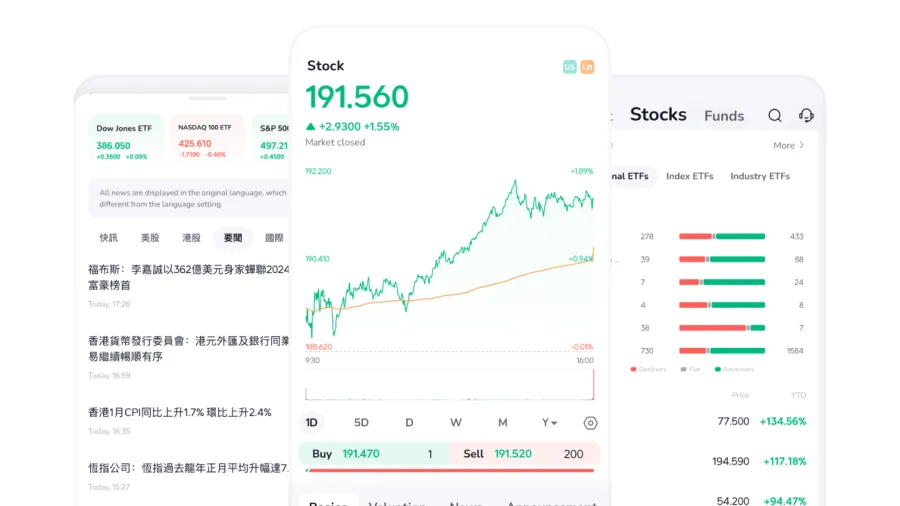

ZA Bank has launched a new business loan within the Global Payments’ ecosystem, allowing for faster loan approval.

Eligible merchants under Global Payments can apply and obtain ZA Bank’s pre-approved credit facilities without the need to submit bank statements and financial reports.

Loan approval results for eligible Global Payments merchants can come in as fast as 3 days, ZA Bank said in a press release.

ZA Bank will make use of a credit modeling system that is expected to streamline the credit assessment process for business loan applications of Global Payments merchants.

ALSO READ: Hong Kong’s ZA Bank kicks off dedicated banking services for stablecoin issuers

The virtual bank will examine the credit health of Global Payments merchants based on alternative data such as the company’s actual business activities.

Since 2021, ZA Bank has approved over HK$3.5b in loans targeting small and medium enterprises (SMEs).

Advertise

Advertise