Australia

Aussie banks' liquid assets can now cover 60% of their wholesale funding liabilities

Aussie banks' liquid assets can now cover 60% of their wholesale funding liabilities

They're now more resilient to liquidity shocks.

Aussie banks urged to improve funding to meet Basel III requirements

They're expected to lengthen their wholesale funding.

BoCom to allow conversion of Aussie dollar into renminbi

Conversion to begin in 2014 as part of the renminbi’s internationalization.

National Australia Bank cuts standard variable home loan rates to 6.13%

It's the lowest of the major banks for 46 months.

Commonwealth Bank, Westpac cut interest rates by 0.25% for home owners

That is for standard variable home loans.

Westpac reports record first-half profit

First half profit to March 31 hits $3.3 billion.

ANZ's profits jumped a measly 1% to US$3.04b

Improved results due to cost cutting and better Asian business.

Australia to secure currency conversion deal with China

Government green lights deal that should cut the costs of doing business with China.

Aussie banks investing massively in Asia

Australia’s cash flush banks’ holdings of Asian assets jump 315% since 2008.

See how financial institutions can maximise video communications

With half of online Australians already engaged with video online and a third using video calling, how can financial services institutions use video to better engage customers and workers?

ANZ posts 6.2% cash profit increase

ANZ posted a 6.2 percent rise in first quarter cash earnings.

Commonwealth Bank of Australia credits retail biz for 1H profit

The Commonwealth Bank of Australia posted a half-year profit of US$3.78 billion.

Commonwealth Bank reports slight profit increase

Half-year profit inched upward by just 1% to $3.66 billion.

Check out which among CBA, Westpac and ANZ was the best in 2012

Let's find out from the 6th East Coles Australian Corporate Performance Report.

Westpac eyes to expand in Asia

Australia’s second largest bank’s major play for Bank of East Asia underscores expansionist leanings.

Hot jobs in Asian banking & finance for 2013

Asia’s banking and finance sector is preparing for 2013 and all eyes are the region as a key barometer of the world’s economic fortunes.

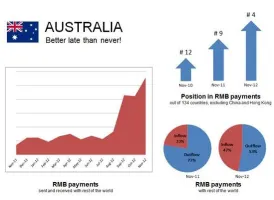

Australia ranks 4th in RMB centres list

The list excludes China and Hong Kong.

Advertise

Advertise

Commentary

Why Singapore’s fast payments need faster protections