Hong Kong

Hong Kong trails behind Singapore in ease of bank account opening for non-locals

Hong Kong trails behind Singapore in ease of bank account opening for non-locals

Startups, SMEs, and foreign nationals lament the inefficiency.

Hong Kong bank loans up 0.9% in June

IPO loans worth $1.95b drove lending gains.

Hong Kong's asset and wealth management business hit $24.27t in 2017

The private banking unit and fund advisory business performed strongly.

Citibank Hong Kong boosts API ecosystem with three new partnerships

Watsons, EGL Tours and Fortress will integrate Citi Pay with Points API into their platforms.

Over 60 applicants scramble for a Hong Kong virtual banking license

This includes Standard Chartered Bank and online loan platform WeLab.

Hong Kong's private banking assets hit $7.81t in 2017

More than half of total assets came from overseas locations.

Hong Kong launches Open API framework for banks

The central bank hopes that lenders start deploying open APIs within six months.

Hong Kong to launch blockchain-powered trade finance platform in September

This involves the participation of the central bank and seven other lenders.

India's bad debt burden is the second worst globally

Trailing only behind Italy, the country has a bad loan ratio of 11.6%.

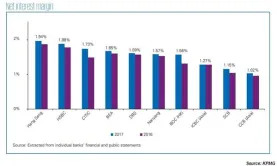

Chart of the Week: Check out how profitable Hong Kong banks were in 2017

Average NIMs of the largest lenders from 1.43% in 2016 to 1.54% last year.

Cash is still king in Hong Kong as only a fifth embrace e-payments

Nearly 70% cite that they remain unfamiliar with the tech required to go cashless.

Credit Suisse's Hong Kong unit ordered to pay $369.08m to settle hiring corruption probe

The bank reportedly made preferential hires to win business.

How can Hong Kong banks reconcile third party data sharing with cybersecurity?

Banks need robust cyber resilience strategies to plug risks.

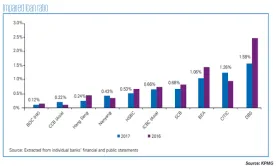

Hong Kong banks' bad loan ratio improves to 0.52% in 2017

Maintaining credit quality is no problem for the city’s top lenders.

Hang Seng Bank to use fintech in credit risk assessment by Q4

Fintech and big data will be used in assessing loan applications.

What can Hong Kong banks gain from turning away from BPOs?

Managed services may just be the way to add further value for banking customers.

Hong Kong banks may lose $14.68m in net assets following HKFRS 9

Replacing the incurred credit loss model is likely to shed off around 1% of net assets.

Advertise

Advertise

Commentary

Why Singapore’s fast payments need faster protections