Hong Kong

Hong Kong banks' cost to income ratios improve despite larger digital investments

Hong Kong banks' cost to income ratios improve despite larger digital investments

The figure dipped from 47.9% in 2016 to 42.5% in 2017.

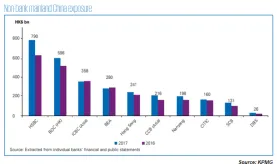

Chart of the Week: Non-bank Chinese exposure of Hong Kong banks doubles to 15% in 2017

Fitch, however, warns against the associated risks of greater Mainland exposure.

Citi hops aboard Hong Kong's chatbot race with planned Facebook Messenger chatbot

Customers will soon be able to check account balance via the messaging app.

Standard Chartered tapped for Alipay's blockchain cross-border remittance service

It will act as the settlement bank for AlipayHK and GCash.

BOC (Hong Kong) moves to beef up private banking business

The bank aims to boosts the number of relationship managers by at least 20%.

Hang Seng Bank onboards SWIFT platform for faster cross-border payments

Payments can be credited within minutes.

HSBC to lift PayMe e-wallet top-up limit

The move aims to ease individual money transfer and purchases.

Hong Kong banks to hike prime rates by end-June

Tighter liquidity from mega IPOs will leave lenders with no other option.

US tightening buoys Hong Kong banks' profitability

Funding costs are expected to stay low, boosting NIMs.

ICBC Asia's Wang Zhi Yong discusses the role of blockchain in cash management

He also talks about the bank's efforts of tapping new technologies.

HSBC shifts into growth mode with planned $17b investment in Asia

The investment will go into the bank's China and Hong Kong markets.

Standard Chartered to apply for virtual bank license in Hong Kong

The move follows the publication of revised guidelines by the central bank.

Hong Kong banks wage war over fixed deposits as interbank lending rates surge

One-year HKD fixed-deposit rate is hiked to as high as 2%.

Heightened Mainland lending pose risks to Hong Kong banks after rising 21% in 2017

The bulk of PRC lending is geared towards lower credit quality firms like SMEs.

Blockbuster IPOs buoy Hong Kong loans 17.1% in April

The city is hosting the back-to-back flotations of Xiaomi and China Tower.

Hong Kong publishes guidelines for virtual banks in Smart Banking push

The central bank is aiming to award licenses towards the end of the year.

Transact with BOCHK ATMs using finger authentication

Bank of China (Hong Kong) Limited’s finger vein authentication offers an answer to the rising security threats looming over Asian retail banking.

Advertise

Advertise

Commentary

Why Singapore’s fast payments need faster protections