Hong Kong

Nearly 2 in 3 Hong Kongers hold a digital bank account

Nearly 2 in 3 Hong Kongers hold a digital bank account

Respondents said digital banks outperform incumbents in account opening promotions.

PAObank extends 16% rate promo on HKD time deposits to July 31

The first HK$50,000 time deposit will enjoy the promo rate.

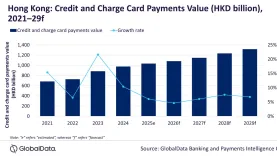

Chart of the Week: HK credit and charge card market to reach $132.4b

Banks are rolling out new services, such as a mobile virtual card and a dual-currency card.

AEON Credit Service’s profit up 31.3% to US$13.9m in Q1

Earnings per share is 26.11 HK cents.

Hong Kong credit card values up 8.4% to $34.91b in Q1

The number of debit card transactions fell although the value rose.

Hong Kong, China launch Payment Connect for faster cross-border payments

Supported services include instant remittance services, amongst others.

BEA property risks persist but capitalisation, funding offer buffers

Its impaired loan ratio is expected to remain high in 2025.

HSBC and Mastercard roll out mobile virtual corporate card in Hong Kong

HSBC’s commercial customers can issue virtual cards through a portal.

Nanyang Commercial Bank still weighed down by property risks in 2025

The de-risking process is expected to take a longer time, Moody’s said.

Hong Kong’s millionaire density trails only mainland China: report

It noted Hong Kong as having one of the highest millionaire densities in the world, second only to mainland China.

BoCom Hong Kong profitability lifted by interest and fee income

The growth of its wealth management business will benefit fee income, says Moody’s

MoneyHero expands wealth product offerings with OSL partnership

Users can now compare digital asset account products.

Hang Seng unveils MTR Jordan Station Retail Banking Centre

It is open from 11 AM to 7 PM on weekdays.

Companies seek real-time liquidity management to avert cash-flow crisis

There is increased corporate demand for liquidity and risk coverage, says HSBC.

Mortgage loans approval increases 2.4% MoM in April

The number of mortgage applications decreased by 7.8% MoM.

HKMA, HKUST Business School ink MoU for applied cybersecurity research

They will explore supervisory tech and regulatory tech.

PAObank names Ronald Iu as chief executive

Iu has previously served as chief executive of two other digital banks in Hong Kong.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership