Indonesia

Citi Indonesia’s net income climbs 52% to $38.29m in Q1

Citi Indonesia’s net income climbs 52% to $38.29m in Q1

Its Institutional Clients Group registered a 2.5% loan growth during the quarter.

Digitalisation and social media distribution: Catalysts for change in Indonesia’s insurance industry

Leaders and experts in insurance and marketing roll out tech-based strategies to unlock growth potential in Indonesia’s untapped market at Jakarta Forum.

Indonesian banks must prioritize digitalisation, boost financial inclusion — experts

Banking leaders at Asian Business & Finance’s Jakarta forum push digital technology and innovation to create seamless and personalised services.

Indonesia, Laos central banks ink cooperative agreement

The partnership was signed last 2 May.

Indonesia, Malaysia launch cross-border QR payment system commercially

The project is now open to the public after more than a year since its pilot phase.

Asian Banking and Finance Forum 2023 arrives in Jakarta in May

Attendees will gain firsthand insights into the trends and developments in Asia’s banking and insurance sector.

DANA bridges the financial divide in Indonesia

DANA's digital wallet empowers the unbanked and underbanked situations in Indonesia and now has 135 million users.

OCBC NISP allocates $87.5m of 2022 net profits as cash dividend

The bank’s annual general meeting of shareholders saw changes made to its board of directors.

Indonesia’s Bank BTN names Nixon LP Napitupulu as CEO

They have also decided that 20% of net profits for 2022 will be used as dividends.

Indonesia’s Danamon to appoint Daisuke Ejima as president director

This plan will be submitted after obtaining approval from the Company's Annual General Meeting of Shareholders (RUPST) on 31 March.

Indonesia’s Bank Danamon expected to hit $245m profits in 2023: analyst

Synergy with parent company MUFG will help grow its corporate and SME loans.

KASIKORNBANK buys controlling stake at Bank Maspion for $186.5m

It now owns 67.5% of the Indonesian bank.

Bank Mandiri reveals its top strategy

Thanks to this strategy, Bank Mandiri’s net profit grew 61.7% YoY in the first semester of 2022, SVP Thomas Wahyudi says.

Malaysia, Indonesia sukuk markets to slow in near-term: Fitch

Issuance in core markets, which include the two countries, fell 14.4% in Q3.

CIMB Niaga steps up its game amidst the digital banking boom trend through its super app OCTO Mobile

Now, OCTO Mobile by CIMB Niaga serves 2.7 million users and sees a 130.5% increase in financial transactions on an annual basis.

Indonesia’s finance and banking sector second most cyber-attacked industry

Financial institutions were attacked triple the average global every week.

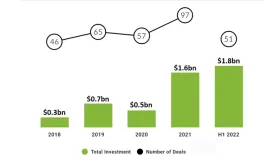

Indonesia’s fintech investments bucks global trend, hits record high in H1

Payment gateway Xendit raised $300m in its Series D funding to help push up the numbers.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership