Japan

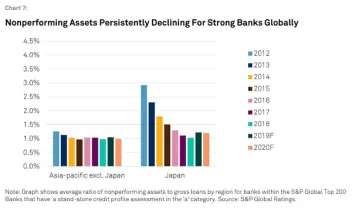

Chart of the Week: APAC non-performing assets to decline further in 2020

Chart of the Week: APAC non-performing assets to decline further in 2020

This will provide a buffer to declining asset quality of banks in the region.

Japan's online financial firm SBI Holdings buys 20% stake at Fukushima Bank

It plans to create a joint outlet that will offer mutual funds, insurance products, and loans.

Cards gain traction in cash-heavy Japan

Total card payments value will hit over $750b by 2022, according to analysts.

Japan's Digital Wallet Corp acquires Philippine fintech

It is renamed Digital Wallet Philippines.

Japanese banks to undergo stress test to assess defenses: source

The banks' capital and liquidity positions will be evaluated.

Japanese regional banks assume more risk to boost bottomline

A crisis or similar shock would lead to downturns more impactful than the GFC.

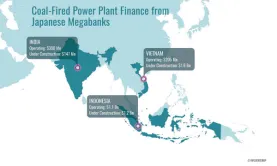

$5b of Japanese megabank loans flow into Asian coal projects

Majority of the loans are financing coal projects in India, Indonesia and Vietnam.

Investment Made Easy - LINE Securities, a New Mobile Investment Service in Japan

The Emerging Mobile Investment Service Launched in Japan LINE Corporation launches the LINE Securities, a mobile investment service, August 20, 2019. Based on the joint venture agreement to form a business partnership to pursue financial businesses focused on the securities business, LINE Financial Corporation ("LINE Financial") and Nomura Holdings Inc. ("Nomura") established LINE Securities Preparatory Corporation on June 1, 2018.

Japanese banks cut over 3,600 employees in 2018 in aggressive restructuring push

Total headcount fell to 223,778 by end-March.

Digital financial services in Japan: What digital consumers want

Digital innovation initiatives are gathering speed at financial institutions around the world. This was made further evident by the Celent Model Bank awards announced in April 2019. The awards recognized 22 projects from 30 countries, and all were initiatives that feature digital elements and innovation.

Bankers are earning less than construction workers in Japan

The average wage of 102 listed banks and insurers dropped 1.4% since 2016.

Japanese regional lenders tie up to combat low interest rate environment

Bank of Yokohama and Chiba Bank’s agreement include retail banking, database marketing and M&As.

Japan Kicks Off Reiwa Era's Payment Infrastructure, Part 2: BOJ-NET

The first section of this two-part commentary was published here.

Japanese banks foray into big data through personal info brokering

Sumitomo Mitsui Trustbank received approval to operate an information bank. Japanese banks are entering a new era as they go into personal info brokering, The Asahi Shimbun reports. The government-backed Japan Federation of IT Associations has given the green light for Sumitomo Mitsui Trustbank and Felica Pocket Marketing, a subsidiary of retailer Aeon Co., to operate a data brokerage service that will allow them to establish an information bank that will buy and sell customers' personal data. Under the service, the company will receive data from customers such as their name, purchase history and health-related information, in trust. Upon customer consent, the bank will provide data to companies that are eyeing to develop new products. Similar to the bank's practice of paying interest on a deposit, customers who shared their information will be compensated with cash, coupons or bank services.

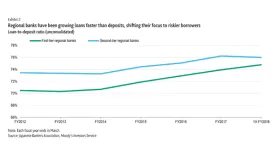

Japan's regional banks cash in on middle-risk loans

The share of real estate in total loans hit a record high 16%, thanks to regional lenders. Regional banks in Japan have been boosting their exposure to firms with higher credit risks and to the real estate sector as they battle against declines in domestic loan yields, Moody’s said in a report. As a result, regional banks have been leading systemwide loan growth, boosting loans faster than deposits. “Some regional banks' strategy is to boost what they classify as ‘middle-risk’ loans to small and medium-sized enterprises (SMEs) that rank on the lower end of creditworthiness,” the report said.

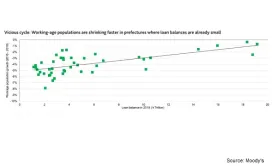

Chart of the Week: Here's where Japanese banks' shrinking loan balances are hitting harder

More than half of lenders based in Chugoku, Koshinetsu, Shikoku and Tohoku earned less revenue.

Visa and LINE Pay teams up to advance mobile payments

It will allow LINE Pay users to transact at over 54 million Visa merchant locations. Visa and LINE Pay will team up to create new financial services experience for their collective user bases of millions of consumers and merchants worldwide. In consumer payments area, active users of LINE will be able to apply for a digital Visa card from within the LINE app, and over time, add any of their existing Visa cards to make payments from their mobile phone. The companies will also offer users additional and enhanced experiences like integrated loyalty programmes and tailored offers and new payment capabilities for users when they travel overseas. The partnership will also allow LINE Pay users to use LINE Pay at Visa’s 54 million merchant locations. These transactions can be viewed through their LINE Pay digital wallet, even where LINE Pay is not directly accepted. Additionally, the team will develop new experiences based on blockchain that enable B2B and cross-border payments and alternative currency transactions and will partner on exclusive marketing campaigns and promotions to contribute to Japan’s acceleration towards a cashless society in the lead-up to and after the Olympic Games. The Visa co-brand programme currently serves 2.3 million customers in Taiwan, and will be launched later in 2019 in Japan.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership