Singapore

Embedded finance platform Credilinq closes $8.5m Series A funding round

Embedded finance platform Credilinq closes $8.5m Series A funding round

It plans to expand to the US, and eventually the UK and Australia.

Singapore in talks with banks to enhance financing schemes for businesses

Local companies have expressed concern on delayed and cancelled orders.

Digital wallets dominate Singapore’s e-commerce payments value

Cards remain the top choice for point-of-sales (POS) spending, according to Worldpay.

Franklin Templeton gets approval to launch first retail tokenised fund in Singapore

Investors will be able to access the fund with a minimum investment of US$20.

Singapore banks deliver resilient Q1 earnings and reaffirms capital mgmt plans

Exposure to clients exporting to the US accounted for just 2% of loans.

PayPal enables payment acceptance from over 200 markets

The new solution allows businesses to hold multicurrency balances.

OCBC integrates stockbroking subsidiaries to Global Markets division

The bank expects to develop “more holistic” wealth propositions for its HNW customers.

GXS Bank names Pei-Si Lai as group CEO

Incumbent CEO Muthukrishnan Ramaswami will become a senior advisor to the GXS Group.

UOB maintains profitability despite possible slower loan growth

Management sees demand for hedging, particularly for foreign exchange.

China’s XTransfer granted electronic money institution license in the Netherlands

They plan to expand services across 30 countries in Europe.

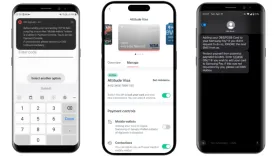

DBS adds extra toggle when adding cards to mobile wallets

This creates a “deliberate pause” for users to verify their intention, the bank said.

Sea rebrands digital finance business SeaMoney to Monee

It has also opened a new headquarters for its digital finance operations.

OCBC’s net profit rose 5% to S$1.88b in Q1 2025

Earnings per share is S$1.68 for the quarter.

DBS’ net profit fell 2% to S$2.9b in Q1 2025 on higher tax expenses.

Interim dividend is 60 cents per ordinary share.

UOB reports flat net profit growth in Q1 despite record fee income

Net fee income rose to a new high but non-interest income fell.

Standard Chartered appoints Noelle Eder as group head of tech & operations

She is based in Singapore and reports to group chief exec Bill Winters.

UOB inks MOU with Accenture for AI adoption and application

UOB will also upskill its employees.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership