Singapore

"Card not present" fraud on the rise: survey

Online fraud risk grows with APAC e-commerce.

Sukuk setback: Singapore’s Islamic finance sector remains dull in 2014

Only one entity was able to sell sukuk.

Here's why Singapore industry loan growth can slow up to 10% in 2014-2015

SGD deposits remain highly disappointing.

Singapore's loan growth climbs to 11.8% YOY in August

Thanks to business loans.

Maybank to open a branch office in Myanmar after license grant

In line with liberalising country's banking sector.

Myanmar confers Foreign Banking License on UOB

Allowing deeper onshore banking relationships.

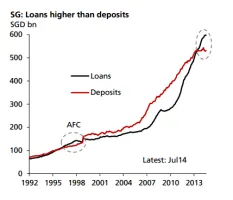

Singapore banks' loans to keep outstripping deposits

Loan growth to hover around 10%.

Financials capture 16.3% of APAC ECM issuance YTD

They got the lion's share.

Follow-on offerings in Asia Pacific soared to highest peak since 2009

Accounting for 63.7% of APAC ECM listings.

Asia Pacific's ECM listings surged to 20.4% to US$146.8b

Strongest 9 months since 2011.

OCBC Bank first in Singapore to enable account opening on-the-go

Their program is targeted for PMETs.

Take a look at how Singapore’s loan growth is nearing the peak of the 1997 Asian financial crisis

Deposit growth languishes near to zero.

42% of Singaporeans duped by "gold card" trap

Don't let looking cool fool you.

Follow-ons drive 2014 Asia-Pacific equity offerings

But total amount down 14% YoY.

Take a look at Asia Pacific’s first Smart Gold ATM that was just launched in Singapore

The Merlion Ingot is in the spotlight.

3 safety nets for Singapore banks amidst property market frailty

Authorities have been proactive.

Advertise

Advertise

Commentary

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership

The future of Asian banking isn’t ‘AI-first’ – it’s ‘fearless-first’