Singapore

OCBC's 4QFY14 earnings disappoint at SGD791m

Higher operating expenses and credit costs cited.

UOB FY14 net earnings jump 8% y/y to S$3,249m

Singapore led slight margin decline.

OCBC's FY14 net profit ballooned 39% to S$3.8b

But it was still below expectations.

Why Singapore banks won't be surprising analysts with impressive gains

Blame it on volatile capital markets.

Hong Kong overtakes Singapore as Asia’s premier wealth management hub

The Lion City is a ‘stagnating’ centre, says Deloitte.

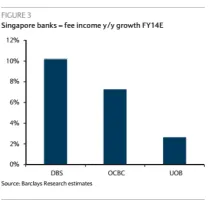

Chart of the Week: Singapore banks to suffer from weak market-related income in 4Q14

Also, trade loans could fall faster than expected.

DBS’ net profit up 10% to $3.8b in FY14

On back of higher NIM, loan volume and fee income.

Here's why 2014 was a challenging year for Singapore banks' loan growth

Growth across the board was sluggish.

Why Sibor's 16bp advancement in 2015 is "unusual" in Singapore

Versus other liquidity-rich markets.

Singapore banks lauded for strong funding franchise

Thanks to rocketing household savings.

Singapore banks' core earnings growth predicted to jump 10% in 2015

Banks are impressively geared up for headwinds.

Singapore banks brace for more delinquent property loans

As shoebox flats flood the market.

Why rising interest rates don't hail the start of "big interest rates upturn" in Singapore

Some considerations must be made, analysts say.

Singapore's UOB sues Lippo, 7 other firms over home loan anomaly

Loans for 37 condos have defaulted.

Singapore banks’ hiring intentions plunge on back of weak market outlook

But compliance and regulation roles are in demand.

OCBC feared to be at highest risk in any housing meltdown in Singapore

Should it feel very afraid?.

Advertise

Advertise

Commentary

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership

The future of Asian banking isn’t ‘AI-first’ – it’s ‘fearless-first’