Singapore

Why Sibor's 16bp advancement in 2015 is "unusual" in Singapore

Why Sibor's 16bp advancement in 2015 is "unusual" in Singapore

Versus other liquidity-rich markets.

Singapore banks lauded for strong funding franchise

Thanks to rocketing household savings.

Singapore banks' core earnings growth predicted to jump 10% in 2015

Banks are impressively geared up for headwinds.

Singapore banks brace for more delinquent property loans

As shoebox flats flood the market.

Why rising interest rates don't hail the start of "big interest rates upturn" in Singapore

Some considerations must be made, analysts say.

Singapore's UOB sues Lippo, 7 other firms over home loan anomaly

Loans for 37 condos have defaulted.

Singapore banks’ hiring intentions plunge on back of weak market outlook

But compliance and regulation roles are in demand.

OCBC feared to be at highest risk in any housing meltdown in Singapore

Should it feel very afraid?.

Which bank in Singapore is susceptible to unchanged interest rates?

This involves the SGD SIBOR as well.

Only 39% of banks confirm payments in real-time: survey

A lot more progress is needed.

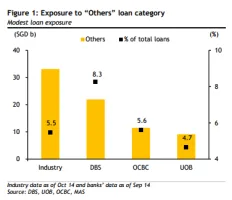

Are Singapore banks dangerously exposed to the fallout from cascading oil prices?

The banks could be affected in an industry shakeout.

Asian financial crown within Singapore's reach

The proposed Shanghai-Hong Kong Connect is a potential game-changer for the world's second-largest economy to entrench itself as Asia's dominant financial hub, but don't count Singapore out of contention.

Singapore's MAS clamps down on delinquent credit card borrowers

Some holders have debts that exceed their annual income.

Singapore banks at risk as ringgit plunges to record low

OCBC is the most exposed.

What can financial firms learn from social networks?

Fear of losing market share sparks constant vigilance among financial services firms, but lately attention has been shifting from traditional competitors to threats from an entirely new sector: social media.

Understanding Asia's multi-tiered mobile payments market

Mobile is fast becoming part of a long-term strategy for banks, financial institutions, and merchants with the rapid convergence of mobile devices, internet, and eCommerce. It represents an opportunity for businesses to achieve considerable growth and satisfy growing expectations of consumers.

Singapore banks’ non-performing loans ticked up as ultra-rich homeowners default

Outstanding housing loans grew 6% in September.

Advertise

Advertise

Commentary

Why APAC banks must rethink their approach to the cost reduction challenge

Thailand backs major conglomerates for digital banks but risks stifling innovation