UOB CEO calls for banks, fintechs, regulators to align on AI standards and trust

Technology should empower people, not replace human judgment and empathy.

Collaboration between banks, fintechs, and regulators is essential to ensure artificial intelligence (AI) and digital innovations can scale safely.

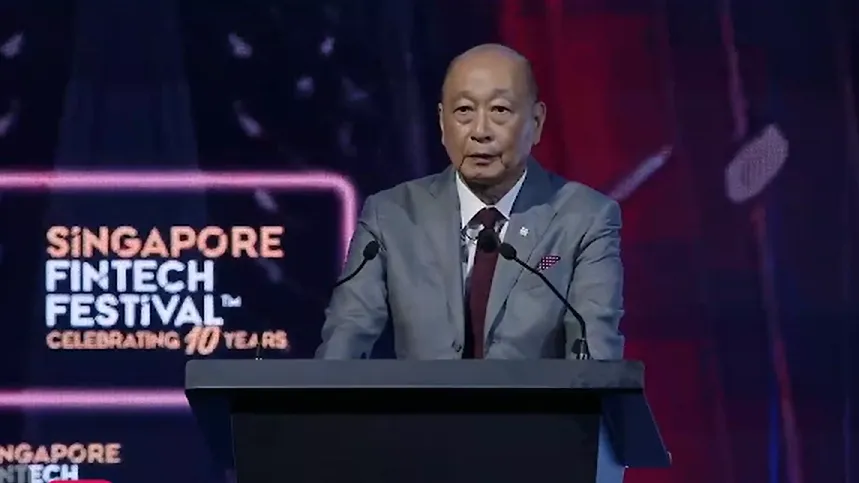

“Banks, fintechs, regulators and industry players must work together on shared standards, trusted digital identities and secure data networks in a faster world,” United Overseas Bank Deputy Chairman and CEO Wee Ee Cheong said at the “Banking Leadership in the Digital Age” session at the Singapore FinTech Festival 2025, held on the Festival Stage on 12 November.

Wee warned that rapid adoption of technology without sufficient safeguards could undermine trust. “Speed without security is fragile. Only trust will build relationships that lasts,” he said, stressing that trust and transparency will be the new competitive edge in financial services.

The chief executive also pointed to practical constraints that companies must consider when adopting AI and other emerging technologies.

He highlighted the promise of AI and blockchain technologies but cautioned that their potential can only be realised with clear regulations and harmonised industry standards.

Whilst technology is transforming finance, he noted that the human element remains essential. “AI cannot replace empathy in advice, ethics in decisions, leadership and judgment, ultimately, trust built over time,” Wee said. “AI should help people to do more and do it faster, not replace them.”

He urged financial institutions to adopt a “mindset first approach, not a technology first approach,” focusing on creativity, curiosity, and problem-solving guided by purpose and values. According to him, technology enables innovation, but it is a people-centric mindset that ensures its sustainability.

Wee urged firms and individuals to continuously learn and adapt. “At the same time, every one of us has a responsibility to ourselves and people around us to keep learning, to upskill and reskill, so that we stay relevant, adaptable and ready for what's next,” he said.

Wee also highlighted regional efforts to promote AI adoption and responsible innovation, noting that the UOB FinLab AI Ready Programme has supported over 1,000 SMEs across ASEAN, helping them take their first steps toward embracing AI.

He added that UOB is involving employees in the innovation journey by establishing an innovation academy for AI upskilling, reaching all 32,000 employees across its regional network.

The bank has also set up an AI and Data Analytics Center of Excellence in partnership with Infocomm Media Development Authority and Monetary Authority of Singapore to develop talent in generative AI and automation.

Looking ahead, Wee said financial services will become smarter, faster, and more inclusive, powered by data and AI.

Tokenisation and near-instant settlement could link ASEAN markets seamlessly with global financial systems, enabling new trade and investment flows.

“If we all work together, we will shape a financial industry that is resilient, adaptive and aligned with society's evolving needs and value,” he said.

“Companies that thrive will be those that prove technology can serve both people and planet, delivering long term value, not short term noise,” Wee said.

Advertise

Advertise