India’s digital public infrastructure gains traction in Global South

The model uses public digital rails to help governments deliver services at scale.

India’s digital public infrastructure (DPI) is emerging as a development model for the Global South as countries look to its open systems that have delivered rapid improvements in services and were formally recognised during the country’s G20 presidency.

The DPI leverages public rails and private innovation with regulatory support, allowing countries to scale services whilst keeping systems open and interoperable.

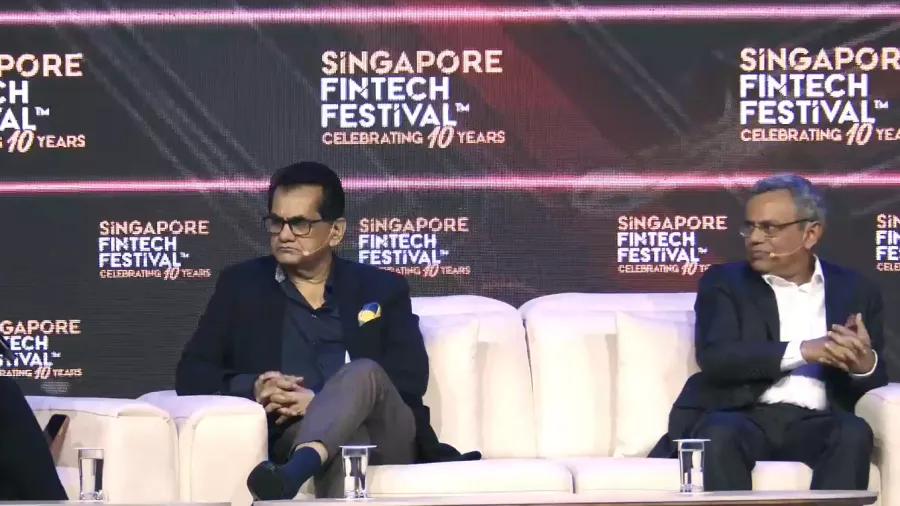

"Technology is an instrument of state power,” Jawed Ashraf, former High Commissioner of India to Singapore and Ambassador to France and Monaco, Indian Foreign Service, said during a panel at the Singapore FinTech Festival 2025.

“In the US, it is an instrument of corporate power,” Ashraf said. “In India, digital technology can be people’s power.”

In addition, the DPI is also a way for countries to avoid fragmentation and uneven access.

Meanwhile, India’s G20 presidency further supported this approach. The country created the Social Impact Fund and contributed $25m as seed capital to gain G20 recognition for systems of digital public infrastructure, despite fierce resistance from some of the “biggest powers,” Ashraf said.

In line with this, interest in the model has been influenced by India’s own experience. Amitabh Kant, former G20 Sherpa of India, said the country uses digital platforms to deliver payments, credit, insurance, and stock market transactions within a minute via mobile.

He added that India was able to “achieve 50 years of progress in seven years” by building digital systems that are open, interoperable and widely accessible.

Meanwhile, the DPI was linked to a broader shift in global economics. “According to the IMF and World Bank, over the next three decades, three-quarters of global growth will come from middle and emerging markets,” Kant said, citing demographic trends, including the ageing populations of the US, Europe, and Japan.

In contrast, existing global structures are no longer aligned with the needs of these economies. “International institutions, which were constituted in the post–World War II era, have outlived their utility.”

Moreover, earlier periods of rapid growth—such as those seen in Japan, South Korea and China—depended on expanding global trade and functioning supply chains. “Today, global value chains are 'disrupted due to protectionism and tariffs.”

Despite such challenges, the industry is entering a period of unprecedented productivity driven by data, machine learning, and artificial intelligence (AI). In India’s case, he said the ability to layer services on top of public digital rails has helped accelerate financial inclusion and reduce service delivery costs for both governments and banks.

“The question for the Global South now is whether it can leverage its own data and computing power to build local large language models and maintain technological sovereignty, or whether it will remain dependent on the West,” Kant added.

Here’s a snippet of the panel discussion below:

Preeti Dawra, Chief Communications Officer, Global Finance & Technology Network (GFTN): What is India trying to do just in the last year to boost entrepreneurship, especially in AI?

Kant: When we started the Startup India movement, we had just over 100 startups. Today, we have around 180,000 startups and more than 160 unicorns. The Indian IPO market has been very vibrant, with many IPOs oversubscribed 40 to 50 times, reflecting the dynamism of the Indian public towards startups. Many of these startups have achieved truly path-breaking innovations.

A critical aspect of our approach is the power to use AI on top of our digital public infrastructure. Lee Kuan Yew once said that India is too diverse and chaotic because of its many languages. However, in the world of AI, linguistic diversity is actually a huge advantage. Through DPI, and with AI tools like Bhashini, a person living in a rural area can interact in their local dialect. India has 22 official languages and thousands of dialects. Using voice rather than writing, individuals can complete government forms, apply for benefits, and access services—all through AI-powered digital public infrastructure.

Dawra: What are some of the three key industries or sectors that India is prioritising today that the world should engage with—and why?

Kant: So, firstly, India has done path-breaking work in green energy. Over 50% of our energy now comes from green sources. Just three days ago, it reached 51%, or 253 gigawatts of renewable energy. The next step is to use this renewable energy to produce green hydrogen, become the world’s cheapest producer, and supply ammonia globally. My first focus is therefore green hydrogen.

Second, India is making a big push in electronics. Apple is investing heavily in manufacturing, and we have introduced both the Production-Linked Incentive and a separate scheme for component manufacturing. This will drive significant growth in electronic component production and create a vast number of jobs.

Third, India is the pharmacy and vaccine capital of the world. Many people may not realise that, without India, the world would have struggled to manage COVID-19. The pharmaceutical and vaccine sectors add immense value and help position India higher up the global value chain. To my mind, these three sectors—green hydrogen, electronics, and pharmaceuticals—are critical for India’s future.

Ashraf: With a country of 1.4 billion people, a median age of 28, and growth of six to seven per cent for the majority of the population, the future is yet to be built. I cannot think of any sector that is not profitable, whether it involves legacy industries or the industries of the future. It is not so much about where to invest, but how to do it. Doing the right thing is important, but doing it right is equally critical.

For India, there is a vast ocean of opportunities. The country offers real stability in a world in turmoil, unmatched geopolitical advantages, unparalleled trust, and, as I mentioned, favourable demographics, strong demand, a supportive environment, energetic people, optimism, and confidence. All of this indicates that in India, there is no sector where opportunity is lacking, whether in legacy industries or emerging ones.

What is particularly notable—especially from a Singapore perspective—is that India has become a top priority for Singaporean investors. This is evident in the way we are structuring our engagement, such as through the inter-ministerial roundtable, which is delivering tangible dividends.

Advertise

Advertise