Lower mortgage rates may have slight effect on Chinese banks and RMBS: Fitch Ratings

Policy adjustments to lower mortgage rates on existing loans could pressure Chinese banks' net interest margins and profitability.

The Chinese banking sector's net profits may decrease by 1% to 5% if banks refinance home loans at lower rates, as urged by the central bank, Fitch Ratings said.

The policy adjustment to lower mortgage rates on existing loans could pressure Chinese banks' net interest margins and profitability, given that home mortgages constitute 20% of the banking sector's loan portfolio.

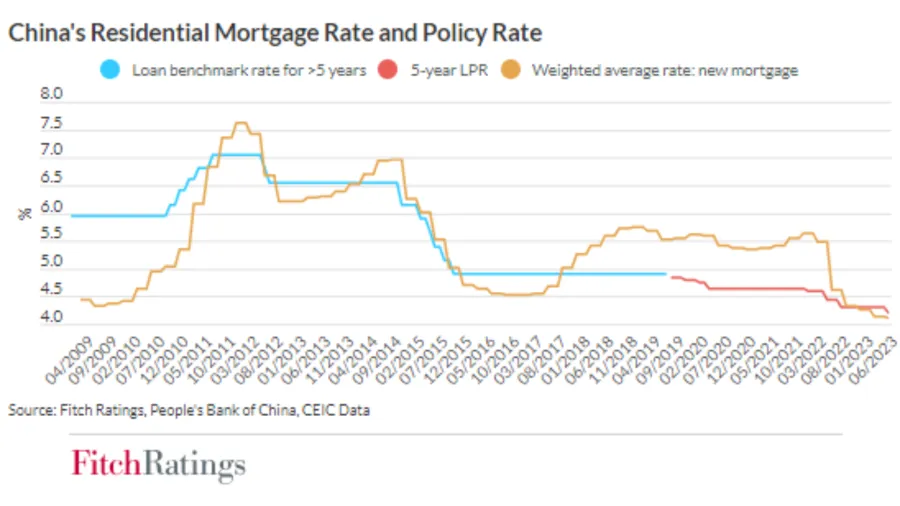

Mortgage loans in China are typically repriced annually based on the loan prime rate, with a constant margin above the prime rate from origination.

Outstanding mortgage loans originated between 2018 and 2022 carry a relatively high-interest rate of around 5%, suggesting potential rate cuts of up to 80 basis points (bps) to align with the current five-year loan prime rate.

Fitch conducted a scenario analysis and found that if 10%, 30%, or 50% of existing residential mortgages were affected by an 80 bp average rate cut, the sector's net interest margin would compress by 1bp, 3bp, and 5bp, respectively, leading to a decline in net profit by 1%, 3%, and 5%.

ALSO READ: SG incumbent banks unlikely to take hit from neobanks' deposit cap raise: Fitch

Fitch Ratings believes a mandatory, blanket rate reduction across all outstanding residential mortgages is unlikely, as the authorities advocate market-oriented pricing for mortgages.

Instead, rate changes are expected to be implemented on a case-by-case basis.

The feasibility of renegotiating existing mortgage rates could alleviate the mortgage prepayment trend, easing pressure on banks' profitability and asset reallocation.

Residential mortgages are considered safe assets for banks, with modest loan-to-value ratios and minimal impaired loan ratios.

For residential mortgage-backed securities (RMBS) senior noteholders, there could be higher reinvestment risk if a large portion of rate reductions is adjusted through new contracts.

However, historical practice suggests that most adjustments were done through contract renegotiations rather than replacement loans.

Subordinated RMBS tranches may face erosion in excess spreads and a thinner margin of safety if interest rates decline on pooled home loans, but lower rates may improve mortgage affordability for homebuyers, resulting in marginally better credit quality in the underlying pools.

Advertise

Advertise