OCBC’s green car loans surged sixfold as new EV brands pique buyers

Loan demand for used EVs rose 30 times compared to launch, the bank said.

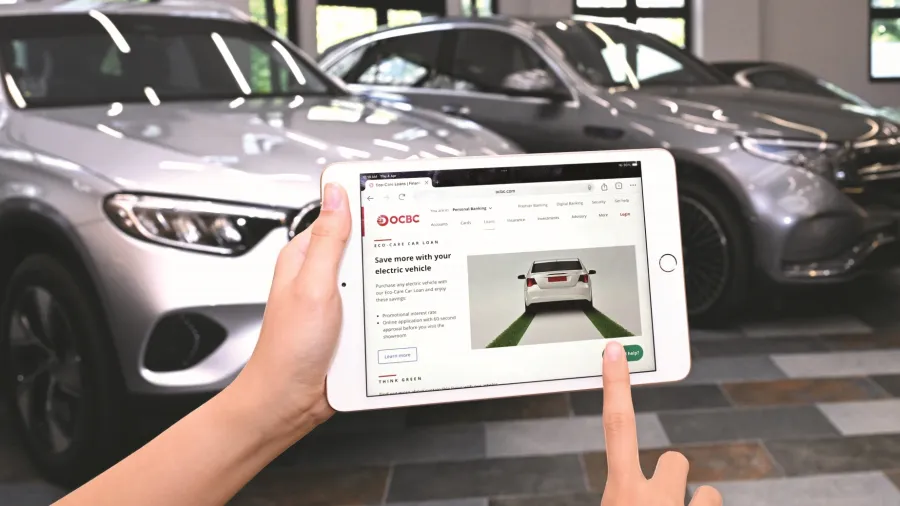

OCBC saw the volume of its Eco-Care Car Loans surge sixfold in 2023 compared to its launch in 2021.

The Singapore-based bank saw the value of loans achieve an average annual growth rate of 170% in 2023, according to a media release.

The Eco-Care Car Loans for new EVs now make up nearly half of the number of loans extended to OCBC customers purchasing new cars in 2023, OCBC said. For used EVs, the volume of loan demand has risen by over 30 times in 2023 when compared to 2021 levels.

OCBC has recently expanded the range of electric vehicles that can be financed under the OCBC Eco-Care Car Loans scheme. Financing is now offered for used EVs up to 10 years old.

The loan scheme offers a preferential interest rate of 2.48% per annum to customers, 0.3% lower than the loans offered for internal combustion engine cars.

ALSO READ: Empathy deficit erodes customers’ trust in banks

EVs have increasingly become popular in Singapore, with the number of EVs registered in the city rising 50.5% year-on-year in 2023, data from the Land Transport Authority showed.

EVs made up 18.1% of all total car registrations in 2023, up from 11.7% in 2022.

Demand surge as the range of EVs in Singapore continues to expand. Newer, more affordable EV brands– many of which are Chinese brands, such as BYD– has piqued further interest. According to OCBC, Chinese brands make up 2 in 5 OCBC ECo-Care Car loans it extended in 2023.

Besides OCBC Eco-Care Car Loans, OCBC also offers OCBC Eco-Care Home Loans, with homeowners given preferential interest rates and bill rebates on their electricity plan. The total amount of such loans growing by over 40% year-on-year in 2023.

Advertise

Advertise