Real time payments, trade partnerships bolster Singapore’s digital trade sector

Its cross-border payment connections have enhanced its international trade competitiveness.

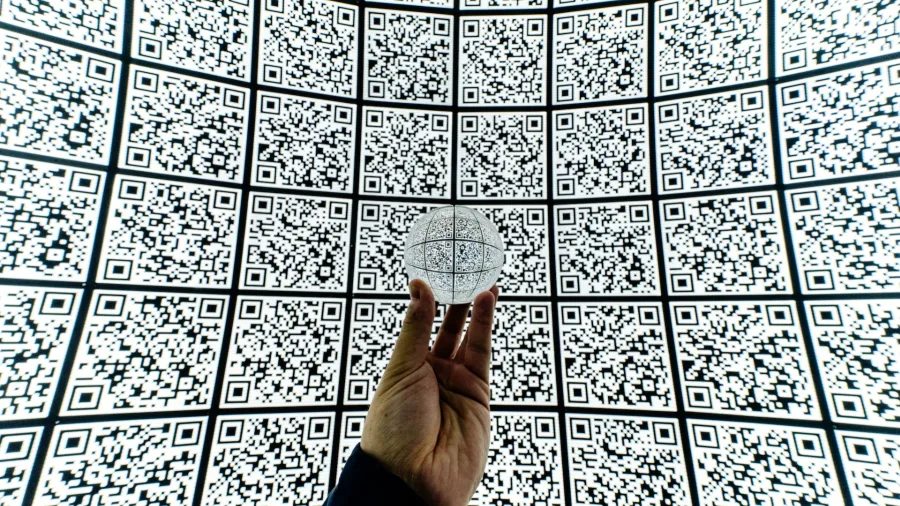

Singapore’s unified QR payment scheme and its real-time payment linkages to neighboring countries are amongst key factors bolstering the country’s digital trade sector.

The launch of SGQR+ in 2023, which enabled merchants to accept up to 23 local and cross-border payment methods, improved digital and cross-border payments in Singapore, according to a report by Deloitte and digital payment and financial platform WorldFirst.

Singapore’s decision to connect PayNow with Thailand’s PromptPay and Malaysia’s DuitNow have also enhanced its international trade competitiveness.

“These policy initiatives significantly reduce the difficulties merchants and consumers face in digital transactions, and encourage more merchants to adopt digital payments, thereby fostering the growth of digital trade,” Deloitte and WorldPay said in the “Going-Global: Seizing the Next Great Opportunity in Digital Trade” report.

Apart from its payment policies, three other factors were named crucial in Singapore’s development of its digital trade sector.

First is Singapore’s position as a global commercial centre, and an international logistics hub, which serves as a foundation for digital trade.

The country’s various trade partnerships globally is also key to the prosperity of its digital trade. These include its Digital Economy Partnership Agreement (DEPA) with Chile and New Zealand; and digital economy trade agreements with Australia, South Korea, and the United Kingdom.

Finally, Singapore is said to fully leverage its market advantages for its e-commerce sector.

“The headquarters of two cross-border e-commerce giants in Southeast Asia, Shopee and

Lazada, are located in Singapore, with their influence extending across the whole Southeast Asian region,” the report said.

Singapore’s e-commerce market size is projected to reach US$8.3b by 2028.

Advertise

Advertise