ZA Bank has detected HK$4b of suspicious financial activities

Its real-time fraud monitoring system screens 100,000 transactions per day.

ZA Bank says that it has boosted its risk control performance by 400% since launching in 2020.

In a press announcement, the Hong Kong-based virtual bank said that it has successfully detected suspicious financial activities involving HK$4b between June 2022 and 2023.

The number of transactions screened by its real-time fraud monitoring system has reached 100,000 per day, based on internal data as of February 2024.

The Hong Kong-based virtual bank said that it has incorporated around 20 digital solutions related to regulation technology (regtech), risk management, and cybersecurity since launch. Nearly half of these were reportedly developed in-house.

ALSO READ: ZA Bank rolls out tax loan, offers cash rewards

Solutions introduced include a real-time fraud detection solution, “X Decision”; and a back-end anti-fraud management system.

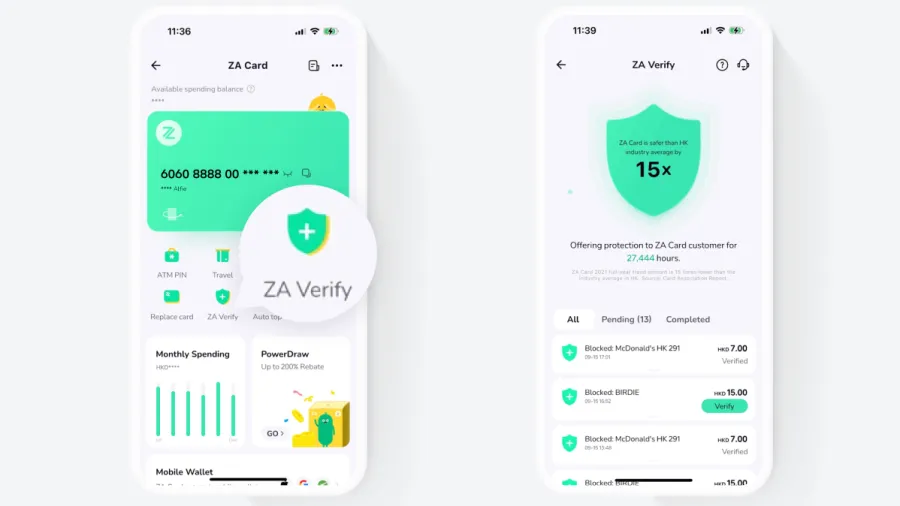

ZA Bank has also developed an in-house risk control scoring model for card transactions. It analyses users’ card transactions and behavioural data. The system scores each transaction and rejects high-risk transactions based on these data, whilst medium-risk transactions trigger ZA Verify, with users asked to confirm or reject a transaction via an app.

The bank shared plans to further promote regulation technology (Regtech) development whilst offering innovative services to customers, it said in a press release.

Advertise

Advertise