News

MoneyHero Group returns to quarterly profitability in Q2 2025

MoneyHero Group returns to quarterly profitability in Q2 2025

Platform membership grew 33% whilst EBITDA loss improved as well.

India’s central bank establishes regulatory review cell

It will ensure the systemic internal review of regulations every 5-7 years.

Regulator urges stronger standards in Australia's private credit sector

A review found opaque remuneration and fee structures, amongst other concerns.

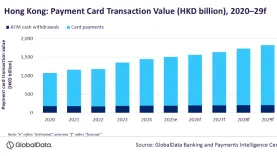

Chart of the Week: Hong Kong card payments to hit $233.5b by 2029

Growing preference for contactless payments will lift the value up.

SCB Easy App unavailable on 5 October 2025

The app is being upgraded during the period, SCB said.

SMBC Group, Jefferies to establish wholesale equities business in Japan

SMBC is also increasing its investment in Jefferies to up to 20%.

BSP probes bank accounts tied to flood control corruption

This comes after a department secretary filed an official request.

Philippine central bank limits daily cash withdrawals, transactions to $8,750

Transactions beyond that must be done through traceable channels like cheques, and online transfers.

Weekly Global News Wrap: Yes Bank ex-CEO charged; US banks cut rates

And a software used by Aussie banks’ is being tested for a possible teen social media ban.

CBA says RBA interchange reforms risk hurting Aussie firms

The Australian bank agreed that debit and credit surcharging should be eliminated.

SMBC to buy additional 4.2% stake in Yes Bank for $101.7m

It has already completed the acquisition for a 20% equity stake in the Indian bank.

APAC instant payments value to reach $170.2b in 2029: GlobalData

China, Japan, South Korea, and India are leading the way.

UOB, Hengfeng Bank, Shangao Holdings ink MOU for Chinese firms’ overseas expansion

They will provide cross-border trade financing and investment banking solutions, amongst others.

ZA Bank backs Hong Kong policies on AI and tokenisation

The Policy Address also introduced support for SMEs.

CBA’s x15ventures teams up with fintech fund Triple Bubble

They will develop a mentorship and talent exchange program.

NAB boards mourns passing of former director David Armstrong

Armstrong was with NAB from 2014-2023.

Hang Seng Bank backs policy measures to bolster markets, finance

Chief exec Diana Cesar said that they will continue to work closely with Hong Kong authorities.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership