News

Regional gains boost Singapore bank loans amidst weakening domestic demand

Regional gains boost Singapore bank loans amidst weakening domestic demand

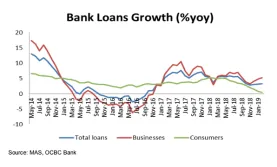

Regional loan growth of 0.3% outpaced domestic loan expansion of 0.2%.

Korean banks urged to break heavy reliance on interest income

Non-interest related earnings made up 12% of 2018 profits.

Indian banks successfully dent bad loans in 2018

The NPL ratio fell to 10.8% from 11.5% the previous year.

Payment apps make headway in cash-heavy Japan

Fintech firm PayPay is setting aside $91m of reward points to incentivise usage.

Hong Kong banks' loan growth slows to 3.03% in February

Trade finance loans fell for the sixth straight month to $60.86b.

Why you shouldn't miss ABF Digital Payments Summit 2019

The region’s payment power players will grace the prestigious event.

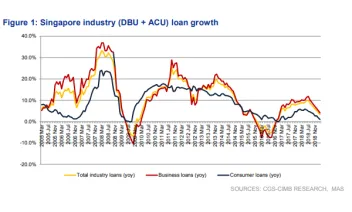

Singapore bank loans grew 3.3% in February

However, consumer loans grew at the slowest pace since at least 2005.

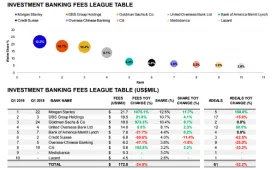

Singapore investment banking fees down 24.8% to $172.8m in Q1

Advisory fees from M&As plunged 63.6% even as deal numbers rose.

Malaysia targets web-only bank license rules by end-2019

The central bank had preliminary talks with internet-only bank operators overseas.

Malaysian banks' pre-tax profit hits $9.04b in 2018

Sector earnings grew at a slower pace due to higher MFRS9 provisions.

Hong Kong grants first batch of virtual banking licences

The licenses were awarded to Livi VB, SC Digital Solutions and ZhongAn Virtual Finance.

Philippine banks eye launch of digital ID registry in 2019

The registry will use blockchain technology for transactions and client identity.

Weekly Global News Wrap Up: Goldman-Apple deal targets mass market amidst shrinking trading revenue; Citigroup joins consumer payments battle

And here’s why banks and Silicon Valley fintechs clash over consumers’ data.

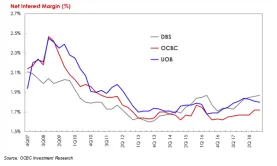

Chart of the Week: Loan re-pricing boosts Singapore banks' interest income

The net interest income of DBS and UOB may rise 9.3% and 7.4%.

Chinese megabanks extend profit decline as credit boom fades

Shanghai- and Shenzhen-listed banks are likely to see 6.7% increase in profit.

Indonesian banks' bad loan ratio down to 2.4% in 2018

The decline comes in spite of recent domestic rate hikes.

Vietnam drafts rules urging lenders to settle bad loans before dividend payouts

The rules will apply to credit institutions and not to state-owned commercial banks.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership