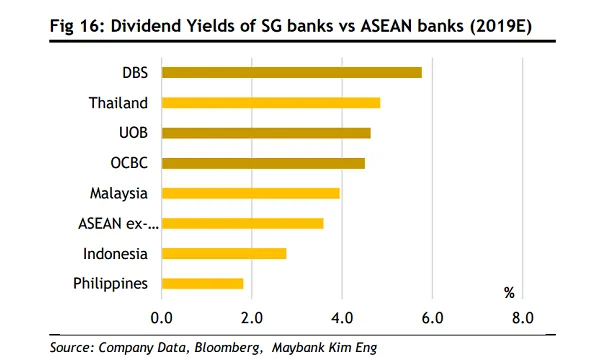

Chart of the Week: Singapore banks' dividend yields eclipse ASEAN peers at 5.1% in 2019

Such levels are higher than banks in Indonesia and the Philippines.

Investors seeking a bang for their buck need not look further else as banks in Singapore offer some of the highest dividend yields compared to their regional counterparts, according to Maybank Kim Eng.

The dividend yield of Singapore's big three banks is expected to average 5.1% in 2019 at fairly unchallenging valuations, analyst Thilan Wickramasinghe said in a report.

"The sector trades at an 8% discount to historical PB yet offers a 2019E dividend yield of 5.1%. This valuation gap should close as ROAs expand and market preference shifts to quality and safety," he said.

DBS offers one of the highest dividend yields in the region followed closely by UOB and OCBC who trail behind Thailand. Indeed, Singapore's big 3 banks' dividend yields are higher than that of lenders in Malaysia, ASEAN excluding Japan, Indonesia and the Philippines.

Although the city state's banks have been consistent in doling out dividends, Maybank's Wickramasinghe notes that the pace of dividend growth has largely been subdued following the Great Financial Crisis due to the double whammy of low interest rates and need to beef up capital to comply with BASEL III requirements.

However, momentum is set to pick up pace in the next few years as higher interest rates is set to provide banks with a sustained earnings momentum. "[W]e believe the sector should deliver stronger dividend growth in the next 3-years compared to the past 10-years. However, the pace of growth should be lower than 2017, which was characterised by a sizable special dividend from DBS on their 50th Anniversary," Wickramasinghe said.

"Despite dividend growth, the sector should be able to manage strong capital adequacy ratios. Continued dividend growth should support a sector dividend yield of 6% in 2019E, which is at the higher end of banks in SE Asia," he added.

Advertise

Advertise