Here's why DBS is more profitable than Barclays

Find out how emerging Asia-centric DBS beats developed market-centric Barclays despite having only half of its equity leverage.

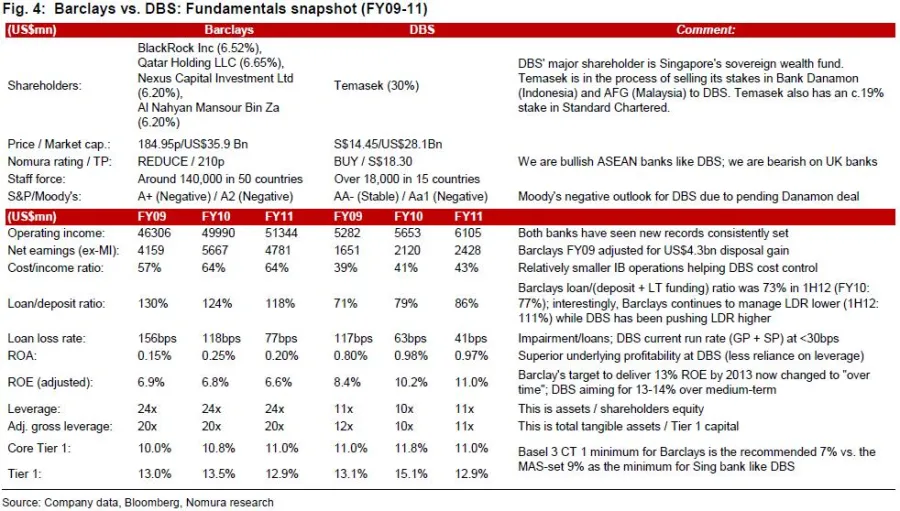

According to Nomura, comparing the fundamentals as condensed in Fig 4 below, DBS is a significantly smaller banking group than Barclays. However, despite having only half the equity leverage of Barclays, it is significantly more profitable as measured in terms of ROA and ROE, supported by better trajectories for key ratios such as cost income and loan deposit (LDR).

"Further, its existing capital base already satisfies regulatory requirements (primarily Basel 3) and lends support to dividend expectations – by contrast, Barclays faces much greater uncertainty in this respect given the additional burdens anticipated from being classified as G-SIFI and having to implement the ICB’s “ring-fencing” recommendations."

Advertise

Advertise