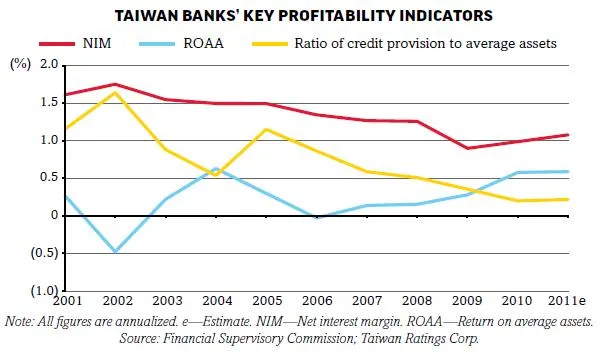

Taiwanese banks' key profitability indicators

Taiwanese banks’ net interest margins are unlikely to improve in the next 2 years, says Standard & Poor's.

According to Eunice Fan, primary credit analyst at Standard & Poor's, most Taiwanese banks have had low credit costs over the past two years, which helped boost the sector’s overall return on average assets (ROAA) to 0.58% in 2010 and 0.59% in 2011, up from an average 0.2% in 2007-2009.

"Nonetheless, we believe the low credit costs in previous years are unlikely to be sustainable in 2012, because global economic uncertainty is likely to cut into the sector’s overall operating performance. Moreover, Taiwanese banks’ net interest margins, which are very low in a global context, are unlikely to show significant improvement in the next one to two years amid prolonged low interest rates and the absence of meaningful industry consolidation," she added.

Advertise

Advertise