Bangladesh’s political situation exacerbates banking system’s problems

Much-needed policy changes may be delayed.

The liquidity and asset-quality of Bangladesh’s banking system is expected to remain challenged for longer amidst the recent volatile political situation.

The country’s central bank governor and other senior banking officials were amongst those who departed following the resignation of former Prime Minister Sheikh Hasina on 6 August. This followed after weeks of anti-government protests that began over a controversial quota system for government jobs.

A week after Hasina’s resignation, banking operations are gradually returning to normal, according to S&P Global Ratings, albeit cash withdrawals are still limited.

“ATMs are now getting loaded with cash under private security cover. As per the latest circular from Bangladesh Bank, banks are to limit cash withdrawals to Bangladesh taka 2 lakh (about US$ 1,700) per account, given the unpredictable security situation,” the ratings agency said in a commentary.

However, the abrupt leadership change may delay implementing much-needed policy changes in the banking system.

"We see risk of policy inaction and a potential slowdown in financial reforms," said S&P Global Ratings credit analyst Shinoy Varghese.

For example, the central bank is due to implement prompt corrective actions in March 2025. This would have forced many banks to focus on capital adequacy, stressed assets, and weak corporate governance.

Elevated risks

Even before the protests, Bangladesh's banking industry already faces structural asset-quality challenges from weak lending standards and foreclosure laws, according to S&P.

State-owned banks also hold substantial amounts of weak assets.

"The unrest will exacerbate these vulnerabilities, and potentially affect economic activity and some borrowers' ability to pay," said Varghese. "Collections have declined, which could further pressurize banks' asset quality."

Liquidity at several banks will remain tight over the next 12 months, S&P said.

"Remittance inflows could get volatile owing to the political uncertainty," Varghese said.

"Disruptions in economic activity and weak external demand should continue to pressure exports. Interbank market activity will remain largely subdued,” he added.

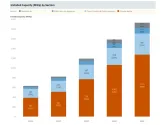

Excessive credit growth in recent years, particularly for Islamic banks, has also weakened domestic liquidity. Many such banks now have loan-to-deposit ratios well above the regulatory limit of 92% for Islamic banks.

A shortage in foreign exchange availability in 2023 had led to delayed payments on US dollar denominated letters of credit of Bangladesh’s public sector and Islamic banks. This situation had been normalizing before the protests started in June.

At least two banks, BRAC Bank and Dutch-Bangla Bank, have been able to meet their foreign exchange obligations on-time, S&P said.

Advertise

Advertise