US banking fallout has little impact on APAC banks, but contagion risks linger

The evolving situation means that problems from secondary effects may rise in the near future.

The recent failures of three US banks will have only a minimal impact on Asia Pacific banks, but the threat of knock-off, secondary effects leaves the door open for contagion risks, analysts said.

Over a span of days, the US banking industry saw its second and third largest failures in history, with California-based Silicon Valley Bank (SVB) and New York-based Signature Bank both collapsing following bank runs.

Just a couple of days prior to SVB’s collapse, a crypto-focused bank, Silvergate, said that it is winding down operations and voluntarily liquidating. Signature Bank also has ties to crypto and was reportedly the second biggest lender to crypto firms after Silvergate, according to local media reports.

S&P Global Ratings analyst Gavin Gunning warned that knock-effects from the US bank failures, particularly SVB, could still affect APAC banks.

"Whilst the failure of SVB has no immediate impact on the ratings on Asia-Pacific banks, the knock-effects could yet have an effect. Stresses that banks can comfortably take in their stride could morph into bigger problems that are difficult to predict,” Gunning said.

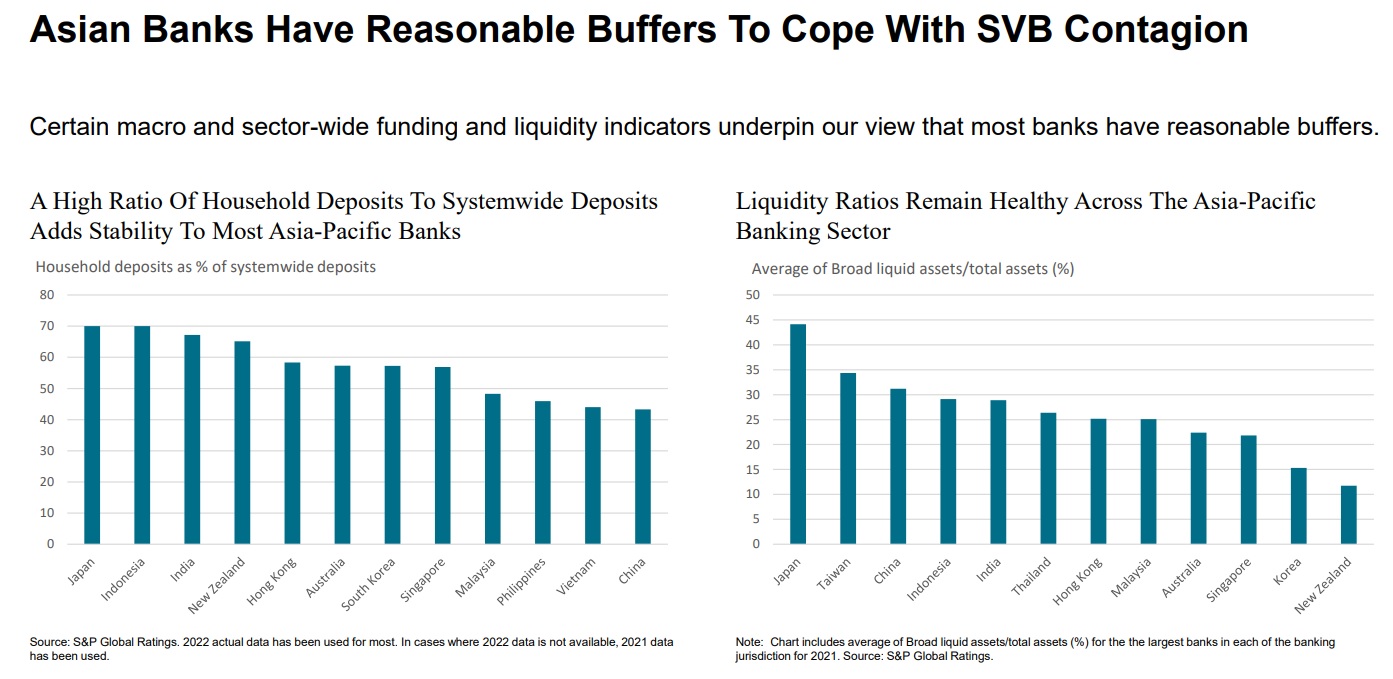

Currently, Gunning and S&P said that APAC banks should have enough buffers to withstand contagion effects.

ALSO READ: Singapore's MAS: banking system sound amidst US bank failures

Schroders’ credit analyst Yustina Quek echoed this, noting that Asian banks are well-regulated and subject to strict liquidity and funding requirements.

“Asian banks also have fairly traditional business models where the loan book is much larger than the investment book, some of which had already been reflected in their capital,” Quek said. “As a result, higher net interest income from the higher interest rate environment could more than absorb mark-to-market losses on the investment book.”

Quek added that the loan books of Asian banks are well-diversified. “The dynamic of tech start-ups or venture capital players drawing down deposits is not relevant for these banks as they don’t tend to serve this clientele.”

Experts from Natixis Corporate & Investment Banking noted that Asia is so far “insulated” from the fallout.

“[The] impact on Asia is so far limited for two reasons. Asia's central banks will have more breathing space as the projected FED rate hikes have been tempered, notwithstanding the higher-than-expected inflation. Asia's markets have also reacted in a milder way than other regions,” analysts Alicia Garcia Herrero, Trinh Nguyen, Gary Ng, and Haoxin Mu wrote in a Natixis report.

The question of contagion

The risk of contagion effects, however, still lingers as a possibility on the horizon–especially as US banks are not the only ones in trouble.

Outside the US, Swiss lender Credit Suisse–touted as one of the world’s “too big to fail” banks–has recently announced that it is borrowing up to CHF50b (approximately £44.5b; US$54b; S$62.9b) to shore up its liquidity.

Back in America, First Republic Bank has received $30b in deposits from 11 of the country’s largest banks with both the government and banking heads on board to assure the public that all is well.

“This is a fast-moving situation and secondary effects could change this view,” S&P’s Gunning warned. "This is the nature of contagion. Foreseeable secondary effects could include increasing risk aversion by investors. This ultimately could result in higher funding costs or other negative consequences for Asia-Pacific banks.”

Natixis analysts also noted that it will only take a “liquidity crunch” in another institution or geography to add fuel to the flame of risk-averse sentiment, and that pressure can be particularly high for the frontier markets.

Advertise

Advertise