OCBC debuts all-digital account application

There will be no need to provide documents as it can easily link to national data repository MyInfo.

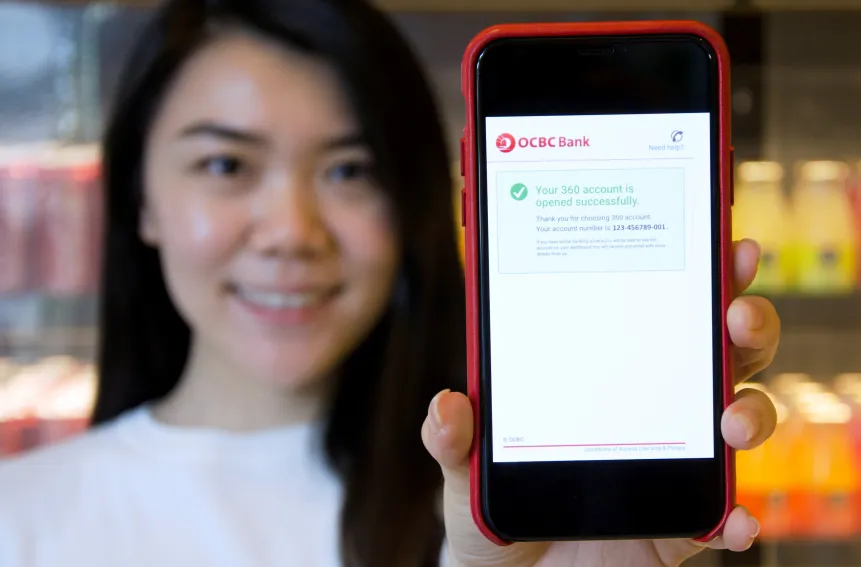

OCBC is rolling out an all-digital, paperless bank account application that leverages to provide customers with a seamless onboarding experience.

Customers don't have to provide identifying documents as the onboarding process leverages on their information from the national data repository MyInfo, enabling customers to open an OCBC 360 account without the need to visit a nearby branch.

Also read: HSBC integrates personal information vault into credit card application process

Customers may log in using their SingPass and consent to OCBC Bank using their MyInfo profile to set up a new account. An online OCBC 360 Account application form is then pre-filled with the customer's personal details. As the bank has fully digitised its digital KYRC process, new account numbers can arrive within seconds of application which can be used right away for electronic transfers.

Also read: OCBC to roll out fingerprint-based credit card payments

“Our ambition is to have one in every two customers on-boarded digitally with zero human intervention, and this launch is a significant milestone in that journey. We will be extending this service to a broader suite of our products shortly,” said Aditya Gupta, OCBC Bank’s head of e-business Singapore.

Advertise

Advertise