South Korean banks’ deposits up by $21b in August

Transferable deposits and time deposits both grew.

Banks in South Korea reported a large increase in deposits taken for the month of August.

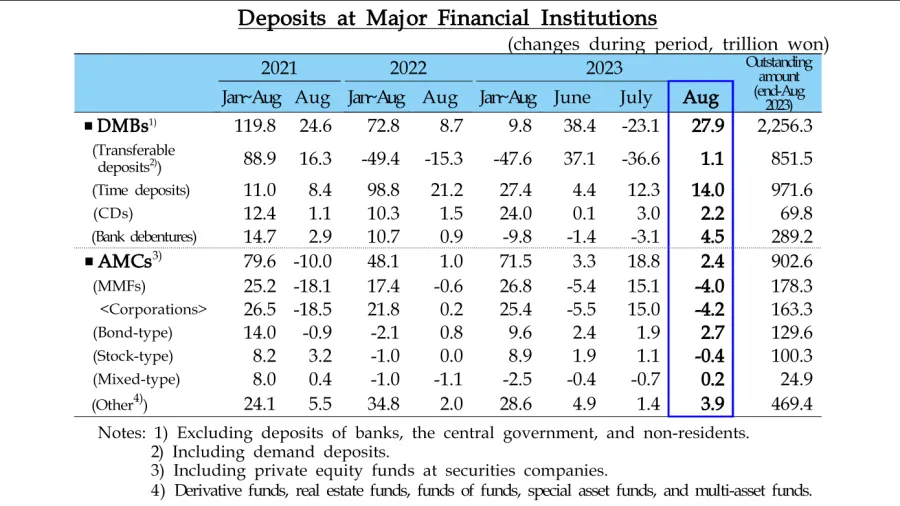

According to data from the Bank of Korea (BOK), deposits taken in by banks rose by approximately $21.03b (KRW27.9t) in August, reversing the $17.4b (KRW23.1t) decline in July.

Transferable deposits rose by KRW1.1t which BOK slightly attributed to the inflows of funds from local governments, including subsidies.

ALSO READ: Bank of Korea launches financial and economic snapshot platform

Time deposits also grew by KRW14t, led by sustained inflows of local government and household funds, and by some banks’ efforts to raise corporate funds.

Funds under management of asset management companies grew by a smaller margin of just KRW2.4t, compared to the KRW18.8t of assets added in July.

Advertise

Advertise