Retail Banking

China banks' time deposits up but loans slow in Q1

China banks' time deposits up but loans slow in Q1

Accounts with specified maturity dates rose 11.8% for ICBC, 7.5% for CCB, and 6.2% for ABC.

Singapore urges caution against intensified phishing attempts

Some emails are claiming to come from the central bank itself.

OCBC profits up 29% to $1.11b in Q1

Higher income from wealth segment and loan related activities buoyed earnings.

NAB's cash profit drops 16% to $2.07b in H118

The bank’s restructuring efforts dragged its profitability.

UOB profits jumped 21% to $978m in Q1

Higher incomes from interest and fees and commissions boosted quarterly earnings.

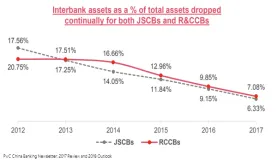

China banks' assets plunge to single digits in 2017 as loans take over

Intense shadow banking crackdown has reinvigorated on-balance-sheet activity. China’s banking system assets plunged from 16.5% in 2016 to 8.7% in...

BNZ profits up 17.8% to $490m in H12018

Sustained corporate and housing lending buoyed monthly revenues.

Scrutiny over Australian banks wrongdoing spill over to New Zealand

The regulator is talking with local lenders to ensure they are not caught up in Australia’s mess.

CBA reveals loss of nearly 20 million bank account records

The bank lost two magnetic tapes containing 15 years of customer data.

ANZ acquisition buoys DBS' loan and fee income figures in Q1

Loan growth rose 10%.

UOB partners with coworking operators to offer rental discount to startups and SMEs

The discounts will cover 33 coworking spaces owned by five Southeast Asian firms.

Hong Kong loans up 3.6% in Q1 amidst intensified construction activities

On a monthly basis, loans for use also inched up 1.2% in March.

Weekly Global News Wrap Up: RBS to cut 792 jobs and 162 branches; Nordic banks' shares plunge in Q1

And Deutsche Bank may also axe 10% of its US workforce.

Chart of the Week: Here's how China's shadow banking crackdown hit assets in 2017

Financial investments and interbank activities were the most battered areas.

Philippine banks' loan growth up 16.4% to $171.93b in 2017

Asset expansion clocked in at a healthy $293.63b.

New regulations to overhaul China's outdated wealth management model

The principal-preserved model may not survive under new rules.

Singapore bank lending up 5.4% in March

Thanks to sustained demand for home and corporate loans.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership