Retail Banking

SMFG’s CET1 ratio climb to 12.75% on higher capital

SMFG’s CET1 ratio climb to 12.75% on higher capital

The Japanese megabank earlier reported a profit of $8.99b for the 9M period.

8 hours ago

Japan Post Bank profit surges 22.4% to $2.46b in Q3 FY2026/3

Dividend is forecasted to be JPY70 for FY2026/3.

10 hours ago

NPCI’s FiMI AI model to handle UPI disputes

It uses an agentic AI framework for multi-step reasoning tasks.

10 hours ago

CIMB tests tokenised sukuk under Malaysia’s digital asset hub

It will evaluate bank-grade tokenisation across issuance, payment, and settlement.

10 hours ago

Maybank pilots tokenised ringgit for cross-border payments

The bank aims to pioneer a range of tokenised assets, from Islamic finance to wealth products.

10 hours ago

NAB underlying net profit jumps 12% to $3.1b in Q1

This was driven by the strong performance of its customer facing divisions.

11 hours ago

Chinese banks miss Hong Kong stablecoin opportunities as rules tighten

China is likely to push the e-CNY as it extends stablecoin restrictions to offshore.

1 day ago

Australia’s BEN to see low credit losses but at risk from housing shock: S&P

Operating efficiency will likely continue to improve on digital investments.

2 days ago

Mizuho FG’s CET1 ratio climbs to 13.76% as capital base grows

The megabank earlier announced that it has achieved 90% of its profit target.

2 days ago

Japanese banks face bond yield shocks as yields hit 2.23%

Megabanks should be able to handle the near-term losses, said Fitch.

2 days ago

ANZ logs $1.38b profit in Q1 2026 on higher deposits and improved costs

The bank’s productivity program is underway, said CEO Nuno Matos.

6 days ago

Hong Leong Bank rebrands wealth segment as HLB Priority and revamps centres

Modernisation of priority centres is scheduled to be completed around March 2026.

6 days ago

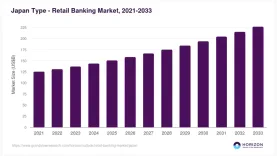

Japan retail banking to hit $227b by 2033

Market revenue stood at $143.7b in 2024 with 5.2% annual growth projected.

6 days ago

OCBC enables Weixin Pay QR payments via bank app

Customers will see rates in real-time before making a transaction.

HSBC Singapore names Suzy White to its board

White is the current group COO of HSBC.

CBA earnings up 1% YoY to A$718m in H1 as deposit margins fall

Customer margins remained flat during the period.

Asia’s banks hold the mandate to innovate. Now they must earn it.

Banking is no longer measured against other financial institutions, but against digital experiences.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership